Today NBER released a paper by Jon Gruber on the tax exclusion (a.k.a tax subsidy) for employer-sponsored health insurance (ESI). Since its content relates to that of many of my prior posts I will draw out a few points I haven’t already raised or that answer some questions I’ve had.

Gruber claims, without citation, that about 80% of those with ESI have access to Section 125 (cafeteria) plans. I wondered about something like this before. Because employee contributions to non-cafeteria plans are taxed the tax exclusion does not apply to every dollar of ESI premiums. Note that the word “access,” in bold above, is his. He is not saying that 80% are enrolled in a Section 125 plan. So this doesn’t exactly answer my question about what proportion of workers are in such plans. A citation would have been helpful.

Gruber correctly points out that a significant benefit of the ESI tax exclusion: it supports the risk-pooling benefits of the employer-based system. One concern is that employers will cease offers of insurance if the tax subsidy were to vanish. Based on his own work (the extensive margin is relatively low) Gruber writes that if the tax exclusion were repealed “there is no reason to think that there will be a wholesale exit of medium and large firms from ESI.” Perhaps a gradual erosion is more likely.

On the other hand, the tax exclusion also promotes purchase of too much insurance (the intensive margin is relatively high). Gruber briefly surveys some of the literature on this point. He also notes the well-known labor market distortions due to an employer-based system that include “limited job to job mobility and distorted retirement decisions.”

Gruber then turns to a brief summary of his microsimulation model that he uses to estimate the effects of changes to the ESI tax exclusion. The model is based on data from the Current Population Survey and the Medical Expenditure Panel Survey and relies on parameters available in the literature. That is, estimates are incorporated from empirical research on employer and individual responses to variations in degree of tax exclusion.

Based on empirical evidence, Gruber makes some assumptions about the insurance-wage trade-off (how saved premium dollars translate into increased wages).

Any firm-wide reaction, such as dropping insurance or lowering employee contributions, is directly reflected in wages. Yet any individual’s decision, such as switching from group to non-group insurance, is not reflected in that individual’s wages; rather, the savings to the firm (or the cost to the firm) is passed along on average to all workers in the firm. (© 2010 by Jonathan Gruber.)

Before turning to the implications of reform options, Gruber notes the limitations of his approach. One is worth highlighting:

If [the] tax subsidy is removed (or mitigated), then healthy workers may find better prices in a more closely experience-rated non-group market, and to some extent abandon the cross-subsidized employer pools. This will raise the price of ESI, which could exert further pressure on healthy workers to exit. This potentially important spiral of rising premiums is not included in the analysis. This effect could be reinforced through the reduced influence of non-discrimination rules that are enforced indirectly through the tax exclusion.

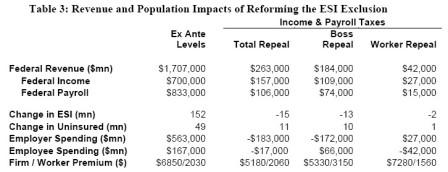

The concluding section of the paper summarizes simulation results for a variety of changes to tax exclusion policy. Included among them are exclusion cap policies, akin to though not equal to the proposed Cadillac tax. I won’t review the results much here as there are too many and they are summarized well in tables at the end of the paper, one of which is excerpted below.