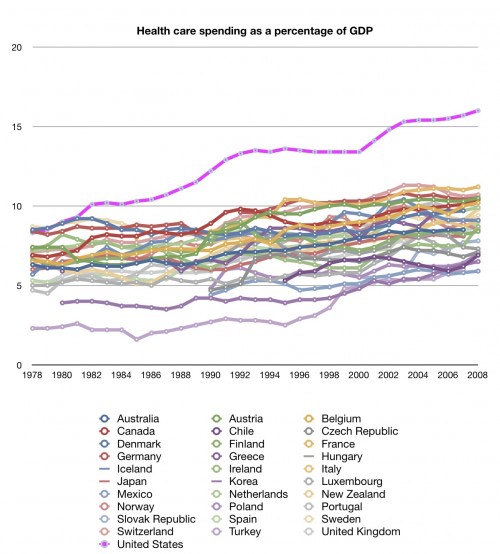

I’ve now had a chance to read Daeho Kim’s working paper “Medicare Payment Reform and Hospital Costs” (ungated pdf). It has already received some attention from Tyler Cowen, Reihan Salam, and Noah Millman, and I’ve already received some comments about it from readers. The key question among the bloggers is whether the phenomenon Kim investigates explains why US health expenditures pulled away from that of other nations beginning in the early 1980s, an upward bending of the cost curve.

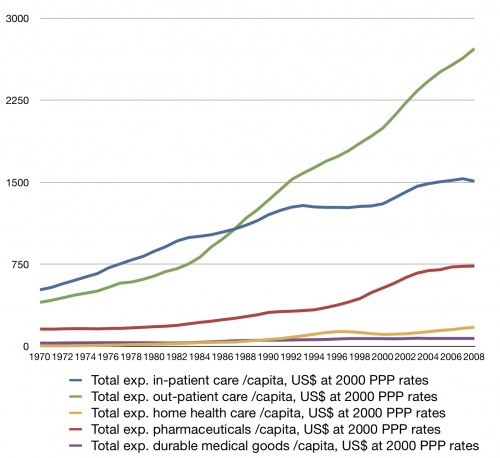

Actually, it’s fairly easy to put that question to rest without reading very far into Kim’s paper. It suffices to know that it’s about how Medicare’s payment system for inpatient hospital services increased use of certain costly inpatient services and inpatient spending. Readers of this blog might recall that the 1980s phenomenon is largely an outpatient one (see chart below). Though it is true that the way Medicare pays for inpatient services affects outpatient spending (through substitution), this is not what Kim’s paper is about. Hence, it does not address the main driver of the 1980s curve bending and, consequently, has been somewhat misapplied in the blogosphere to date.

The payment reform on which Kim focuses is Medicare’s shift from retrospective to prospective payment for hospital services, phased in in the early 1980s. The key difference between the two payment schemes is that the former pays hospitals whatever they claim their costs are and the latter sets prices for procedures, putting hospitals at risk for covering costs above the set prices or reaping gains if they can provide care below them.

Abstracting many details, Medicare’s hospital prospective payment for a procedure is its national average cost. Therefore, if a hospital’s marginal cost for a procedure is below the national average cost, the hospital has a huge incentive to do more procedures of that type. This, Kim rightly points out, is a perverse incentive, having nothing to do with the need or appropriateness of those additional procedures. It could cause higher spending than necessary for appropriate care. Kim’s results suggest it did just that.

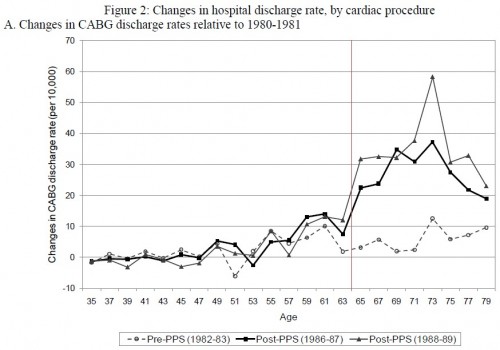

I show that an unintended consequence of PPS [Medicare’s inpatient prospective payment system] was to generate financial incentives for hospitals to expand treatments that had average costs greater than marginal costs due to sizable fixed investments – i.e., the Medicare payment would be greater than the treatment cost at the margin. In the context of cardiac treatments, coronary artery bypass graft (CABG) surgery has a greater average-to-marginal cost ratio than angioplasty, whose ratio is greater than drug therapy’s. […]

[T]he use of costly medical technology (CABG) had been increased due to financial incentives faced by hospitals to exploit economies of scale under PPS. Furthermore, hospitals expanded CABG use by treating relatively healthier patients for whom the alternative technology (angioplasty) was readily available and medically substitutable at a lower cost. The results of this paper may therefore provide one of the explanations for the continuing rise in health care costs, despite the efforts of policymakers to contain them.

Kim’s analysis is thorough and employs a strong, regression discontinuity design. Even if you don’t want to spend the time on the technical details of the paper, I highly recommend turning to the end and flipping through the figures and tables, of which there are many. Below is just one figure that illustrates the basic result. The horizontal axis is age. The vertical axis is change in CABG discharge rate relative to that of 1980-1981 (pre-PPS). Shown are results from three time periods: 1982-1983 (also pre-PPS), 1986-1987 and 1988-1989 (both post-PPS). The vertical line at age 64 indicates the boundary between the Medicare-eligible ages and not (ignoring non-age based eligibility, which Kim addresses elsewhere).

There is a clear discontinuity pre- and post-PPS across the age 64 boundary. This suggests that Medicare’s PPS included strong incentives for additional CABGs, diverting patients that might have benefited more from angioplasty (results for which do not exhibit the same discontinuity). However, when I posted Kim’s paper to last week’s Reading List, physician Steve Sisson commented,

[I]t should be remembered that even back then we knew that angioplasty did not work for very long. A single angioplasty was cheaper than CABG. The multiple angioplasties needed to equal a CABG, especially a LIMA graft, were more expensive. […] People forget that we used to not do CABG surgery on patients in their 80s. The research showing that we could safely operate on octogenarians came out in the 80s.

Thus, there were other possible explanations for an increase in CABG over angioplasty around the same time PPS was phased in. On the other hand, Kim also analyzes four states that were exempt from PPS and no discontinuity similar to that shown above is exhibited by them. That would seem to separate the PPS effect from the effect of medical science described by Steve.

It would not be surprising at all if PPS was not the best payment system. However, Chapin White does give it some credit for the decreasing rate of growth in per beneficiary Medicare spending, at least over the long term. Also, private plans followed Medicare’s lead, adopting PPS later (in the 1990s, Kim told me by email). Further, other countries use PPS-like systems (Germany, Sweden, and Italy beginning in the 1990s, says Kim, again by email). No law or international treaty forced all these health payers to use PPS. If Medicare was duped, it was not alone. It seems nobody else had a better idea.

Actually, Medicare itself did have a better idea. From 1991 through 1996, the program experimented with a different payment approach for CABGs. Robert Coulam, Roger Feldman, and Bryan Dowd summarize:

[The] Coronary Artery Bypass Graft Demonstration [n]egotiated bundled payment for Part A and Part B services for coronary artery bypass graft (CABG), which allowed participating organizations to create payment approaches that rewarded physicians for reducing the cost of care. [Medicare] implemented the demonstration initially at four sites in three cities. Three other sites were added later. Pressure from providers significantly diluted the negotiation model to a discounted bundle of Part A and B services. [Medicare] estimated the demonstration saved [the program] nearly $40 million (10 percent) in 10,000 CABGs performed at the seven sites.

This suggests that greater bundling (which is part of the ACA) and competitive bidding (which is not) could save more money over standard PPS. That makes sense since what gets bundled tends to be lower fixed cost pre- and post-operative visits and rehab. As average costs of the bundle approach marginal costs, the issue raised and illustrated by Kim diminishes. Naturally, forcing providers to compete for Medicare volume also provides incentives to lower prices. Medicare’s struggle to implement competitive pricing is decades old. Click through to see who is mostly to blame for that.

AF