In a Health Affairs paper published last week, Michael McWilliams, Christopher Afendulis, Thomas McGuire, and Bruce Landon examine how Medicare beneficiaries respond to the large number of health plan choices available to them. The perspective and results are consistent with other findings and my own intuition and experience observing my mother shop for Medicare plans. However, as I’ll return to at the end of the post, their results, combined with the search frictions work I described last week, lead to a paradox.

First, some background from McWilliams et al.:

[M]ore choice may be detrimental if there are too many or overly complex options, particularly in high stakes decisions that involve health or money.3,4 Consumers may choose inferior options or make no choice as a result of cognitive overload, anticipated regret, or bias toward the status quo.5–9

Therefore, providing seniors with more health plan choices could increase enrollment in Medcare Advantage or could decrease enrollment if beneficiaries become overwhelmed and choose traditional Medicare by default. Moreover, elderly Medicare beneficiaries with cognitive deficits may have particular difficulty identifying the most valuable option from a complex set of Medicare Advantage and traditional Medicare alternatives. 10,11 […]

Previous research suggests that the many and complex plan offerings in the Medicare Part D prescription drug program contribute to suboptimal choices by elderly beneficiaries, thereby limiting the gains from competition.15–19

This is the standard view. Too much choice among complex options is paralyzing, giving rise to status quo bias. I’ve experienced it myself. In the context of McWilliams et al., the status quo is traditional Medicare, as opposed to Medicare Advantage. It’s the natural default option, the most popular choice by far (about three-quarters of beneficiaries choose it today), and relatively simple, if less generous in certain ways.

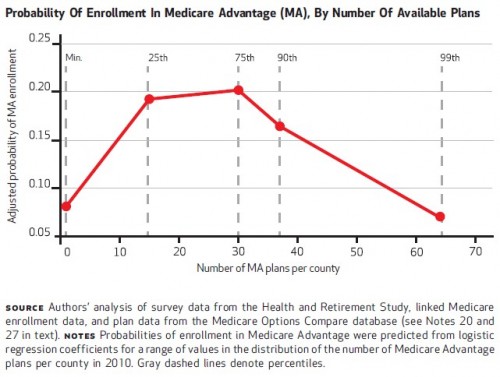

Still, people value choice. So, we want some, but not too much. If status quo bias increases with number of choices, too many options is self-defeating. What’s the right number of Medicare Advantage plans? Take a guess, then check out the chart below.

In the chart, “adjusted probability” is the raw probability, controlling for cognitive ability and other beneficiary socio-demographic characteristics, out-of-pocket costs for various options available, and prior traditional Medicare enrollment (details in the appendix). Enrollment into Medicare Advantage peaks at about 30 plans. (Interestingly, today there are also about 30 PDP options available to Medicare beneficiaries.) Does that mean 30 is the “right” number of plans. No. It is the number that maximizes enrollment. That is all. By itself, it does not imply beneficiaries are making good choices.

One explanation for low enrollment with low Medicare Advantage plan number is the poor matching between plans and beneficiaries. As choices grow, more beneficiaries find plans that suit them. But if choices grow too numerous (above 30), enrollment falls again, as shown in the chart above.

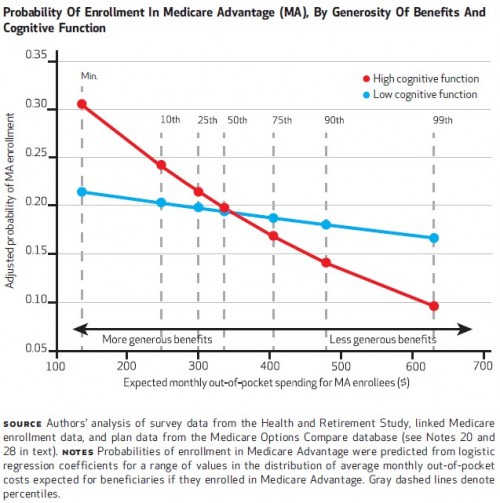

All other things being equal, Medicare beneficiaries should be more likely to enroll in Medicare Advantage as benefits of the program grow. However, to the extent that beneficiaries’ ability to comprehend choices relates to willingness to deviate from the default option (traditional Medicare), there should be different enrollment responses between those with low and high cognitive function. That is, enrollment among those with more difficulty processing complex information should be less responsive to plan generosity. That’s exactly what the authors found, as shown in the following chart.

Though all of the above is intuitive to me, and probably to you too, there is a paradox. Consider the search frictions findings of Randall Cebul, James Rebitzer, Lowell Taylor and Mark Votruba, about which I posted last week. They explained that search frictions are the cause of greater plan turnover, at least among fully insured firms. Search frictions, as you might recall, are anything that impedes the arrival or processing of information.

Wouldn’t more plans increase search frictions? That seems plausible to me. But if search frictions cause more plan turnover, what’s the source of status quo bias? My intuition is consistent with McWilliams et al., that search frictions impede switching (status quo bias) not encourage it.*

This paradox can be resolved. I’ll provide the explanation tomorrow.

* I’m purposefully generalizing. Cebul et al. studied firms. McWilliams et al. studied Medicare beneficiaries. I’m presuming, or assuming, the results of both generalize. I find that plausible.

References

3 Botti S, Iyengar SS. The dark side of choice: when choice impairs social welfare. J Public Policy Mark. 2006;25(1):24–38.

4 Kunreuther H, Meyer R, Zeckhauser R, Slovic P, Schwartz B, Schade C, et al. High stakes decision making: normative, descriptive, and prescriptive considerations. Marketing Letters. 2002;13(3):259–68.

5 Anderson CJ. The psychology of doing nothing: forms of decision avoidance result from reason and emotion. Psychol Bull. 2003; 129(1):139–67.

6 Dhar R. Consumer preference for a no-choice option. J Consum Res. 1997;24:215–31.

7 Gilovich T, Medvec VH. The experience of regret: what, when, and why. Psychol Rev. 1995;102(2):379–95.

8 Iyengar SS, Lepper MR.When choice is demotivating: can one desire too much of a good thing? J Pers Soc Psychol. 2000;79(6):995–1006.

9 Samuelson W, Zeckhauser R. Status quo bias in decision making. J Risk Ins. 1988;1:7–59.

10 Finucane ML, Slovic P, Hibbard JH, Peters E, Mertz CK, MacGregor DG. Aging and decision-making competence: an analysis of comprehension and consistency skills in older versus younger adults considering health plan options. J Behav Dec Making. 2002;15:141–64.

11 Hibbard JH, Slovic P, Peters E, Finucane ML, Tusler M. Is the informed-choice policy approach appropriate for Medicare beneficiaries? Health Aff (Millwood). 2001;20(3):199–203.

15 Abaluck JT, Gruber J. Choice inconsistencies among the elderly: evidence from plan choice in the Medicare Part D program. Cambridge (MA): National Bureau of Economic Research; 2009. (Working Paper No. 14759).

16 Hanoch Y, Rice T, Cummings J, Wood S. How much choice is too much? The case of the Medicare prescription drug benefit. Health Serv Res. 2009;44(4):1157–68.

17 Winter J, Balza R, Caro F, Heiss F, Jun BH, Matzkin R, et al. Medicare prescription drug coverage: consumer information and preferences. Proc Natl Acad Sci USA. 2006; 103(20):7929–34.

18 Kling JR, Mullainathan S, Shafir E, Vermeulen L, Wrobel MV. Misperception in choosing Medicare drug plans [Internet]. New York (NY): City University of New York; 2009 [cited 2011 Jan 13]. Available from: http://web.gc.cuny.edu/economics/ SeminarPapers/Fall%202010/ Kling.pdf

19 Tanius BE, Wood S, Hanoch Y, Rice T. Aging and choice: applications to Medicare Part D. Judgm Decis Mak. 2009;4(1):92–101.

UPDATE: For clarity.