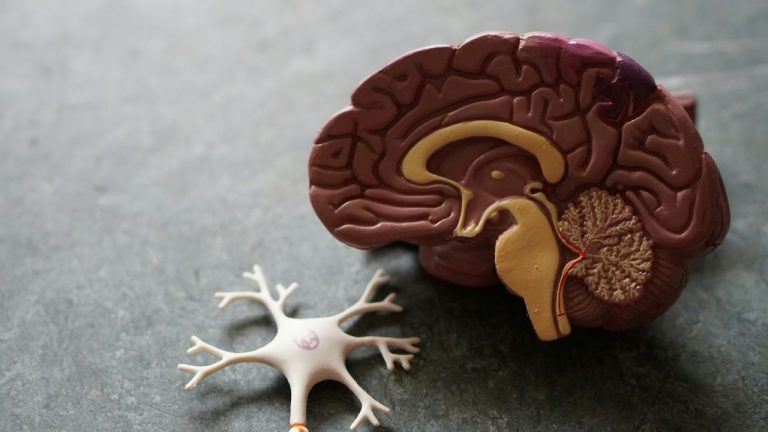

Massachusetts Led on Dementia Policy Once. Can it Lead Again?

Massachusetts has a chance to lead on state policy around Alzheimer’s and dementia in 2026, if lawmakers choose to prioritize it.

Massachusetts has a chance to lead on state policy around Alzheimer’s and dementia in 2026, if lawmakers choose to prioritize it.

Massachusetts has a chance to lead on state policy around Alzheimer’s and dementia in 2026, if lawmakers choose to prioritize it.

Medicaid retroactive coverage changes shift costs to patients, but hospitals can cushion the impact using 340B funds

A more useful definition of dementia-friendliness must center on state policy.

Despite popular belief, drug price transparency does not guarantee affordable prices or fair access to medicines.

The public discourse about video games and health largely focuses on the potential risks, but what about the benefits? The answer may surprise you.

Trump’s drug pricing policy promises headlines but not savings – Americans still pay triple, while real reform remains out of reach.

Prescription drug costs in America are too high – will Congress rein in the middlemen in the supply chain that contribute to this problem?

Can digital health platforms like Zocdoc and Solv help close care gaps for dual-eligible patients?

Cutting federal funding for the 9,000 public libraries serving as vital, local health hubs would negatively impact communities.

As the Inflation Reduction Act empowers Medicare to negotiate drug prices based in part on clinical benefit, and as the FDA more closely scrutinizes accelerated

The Trump is cutting the health care coverage, programs, and infrastructure older Americans rely on.

Pharmacy benefit managers (PBMs) have recently been the focus of media and legislation, but what do they actually do?

Improving dementia care coordination will help patients and caregivers, reduce health care use, and lower costs.