This is the second of two posts today on health insurance search frictions. I assume you’ve read the first one.

As promised, this post summarizes some of the content of Unhealthy Insurance Markets: Search Frictions and the Cost and Quality of Health Insurance, by Randall Cebul, James Rebitzer, Lowell Taylor and Mark Votruba.

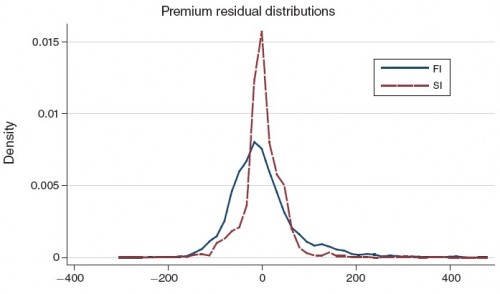

The effect of search frictions on premiums is illustrated in the following chart from the paper, but it isn’t obvious. I explain below.

The chart is the probability density of “residual premiums” (the horizontal axis). Residual premium is the portion of premium that cannot be explained by characteristics of the plan and its potential enrollees. In other words, it’s the result of an attempt to control for the fact that plans in a market vary in their benefits and cost sharing as well as in the health risk of the population that enrolls in them. All these factors affect premiums and are what make comparing plans apples to oranges (or aardvarks).

In computing residual premiums, the authors controlled for “plan type (Preferred Provider Organization (PPO)/Point of Service(POS)), deductible level, copayment for typical office visit, the inclusion of prescription drug coverage, and such characteristics as firm and establishment size, percent of workers who are full time, percent female, age distribution of workers, and mean payroll.” This is, obviously, not a complete set of controls. What the authors assume is that (a) premiums in the SI market reflect variations in marginal costs governed by unobservable characteristics and (b) those unobservable characteristics have the same effect in the FI market as in the SI market. Consequently, the dispersion of SI residual premiums shown in the chart above serve as a counterfactural to that of the FI ones.

The FI distribution has greater dispersion than the SI one, reflecting greater search frictions. (If it isn’t clear to you why this should be, go back to the first post.) The authors use the differences between these two distributions to estimate the implications of those search frictions. They find that search frictions in the FI market led to a transfer of $34 billion in consumer surplus (consumer value) from consumers to insurers in 1997. They also find that frictions led to greater plan turnover, with 64% more FI groups and their members switching plans than would have otherwise (about 20% of policyholders switched plans in a year). That’s troubling because plan switching is a disincentive for plans to invest in preventative care, which is under provided in the US.

So, what’s to be done about search frictions and the trouble they cause in the market? The authors point to a government solution in the form of a subsidized public option that is simple to understand, though does not provide the flexibility that some segments of the market demand.

The socially optimal government policy is to price the public insurance backstop option below cost! Note that this policy will not completely crowd out private insurance, as privately provided insurance is more highly valued than government-provided insurance. Indeed, the size of the optimal subsidy is limited by the welfare costs of attracting clients away from superior private options. Rather, the intervention displaces insurance offerings on the far-right tail of the distribution, i.e., the highest-priced policies, and in so doing makes the market more efficient.

A subsidized government plan has ripple effects that alter incentives and prices throughout the market. A properly chosen backstop plan improves market efficiency by moderating the arms race in marketing. More precisely, […] the subsidy reduces the payoff to marketing for all insurers; thus, each insurer can spend less without ceding an advantage to competitors. The government subsidized insurance also makes private insurance more attractive to consumers by compressing the distribution of prices toward marginal cost.

Opening up state insurance markets to provide more competition from out-of-state plans is, perhaps, the antithesis of a single, simple public option. About it, the authors write,

[I]n a search model, an increase in the number of insurers need not lead to lower prices if it does not reduce the cost to insurers of marketing and medical underwriting or reduce the cost to employer groups of evaluating offers. Indeed, this sort of proposal might exacerbate frictions resulting from information overload.

Finally, they conclude,

Health insurance reform is among the most pressing policy issues in the United States today. A better understanding of the causes and consequences of search frictions will be important for formulating better policy and improving the efficiency of insurance markets.

Even if one disagrees with the authors’ economic models, empirical technique, or conclusions, one cannot easily dismiss this conclusion. Those who view a public option less favorably and prefer a market with more options for consumers, for example, should be (and are) concerned with enhancing the ability of consumers to make good choices, thereby encouraging better functioning markets. Other than those who profit from them (no trifling interest group), we should all be concerned about search frictions in insurance markets.