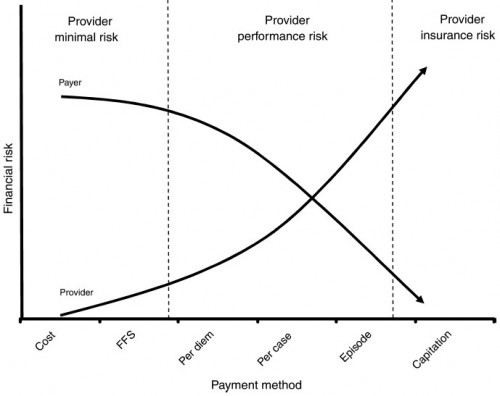

Austin posted this interesting figure from Averill, et al. (JACM, 2010):

A few legal comments (I can’t help it):

- Insurance companies are generally regulated by the states.

- In most states, everything to the right of the second dotted line (“Provider insurance risk”) requires the provider to obtain a state health insurance license, perhaps with millions of dollars in solvency reserves and insurance company regulation.

- In some states, everything to the right of the crossover point could also require some sort of state health insurance license.

- In the 1990s, when provider groups wanted to accept performance and insurance risk on Medicare Part C, Congress created a special regulatory process – the Provider Sponsored Organization (PSO) negotiated rulemaking – in order to pre-empt state insurance law and permit providers to accept more risk without holding ordinary solvency reserves. After the PPMC debacle in the late 1990s, the rules were largely forgotten.

- Medicare ACOs should be exempt from state health insurance solvency regulation, but only for Medicare patients (and only if CMS will pick up the bill). For the other payers, we might dust off the interim final PSO rules (cached version here) as a starting point.