Sick of reading posts about market theory and health care costs? If so, skip this one and read this alternative post from the archives. It has nothing to do with health care costs or market theory.

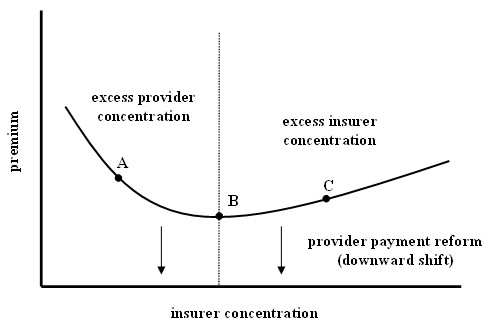

Meanwhile, I’m obsessed with what market theory can tell us about health care costs. It’s a good thing because it’s my job (or part of it). Anyway, let’s revisit my favorite graph, which you might recall from prior posts on this topic. It illustrates how I think insurer market concentration relates to premiums (or health care costs in general), holding health care provider concentration fixed (the curve shifts up (down) for higher (lower) provider concentration).

While this graph explains a lot, it doesn’t explain everything. In particular it abstracts away the role played by what the insurers actually provide for the premium charged. The curve is for the average standardized premium, which means all the variations in benefit packages offered by insurers are taken into account or controlled for, adjusting the premium accordingly.

While this graph explains a lot, it doesn’t explain everything. In particular it abstracts away the role played by what the insurers actually provide for the premium charged. The curve is for the average standardized premium, which means all the variations in benefit packages offered by insurers are taken into account or controlled for, adjusting the premium accordingly.

Of course benefits matter for enrollment, which is the source of insurer market power. The greater number of enrollees, the greater the power of the insurer. Most benefits are of the form “such-and-such is covered for a copayment of thus-and-so.” But one benefit is of a different flavor than all the rest. That benefit is the provider network.

The provider network is the set of providers to which policyholders have access through the insurer. Go outside that network and you’re not covered; you have to pay for the service entirely out of pocket. Of course the establishment of the provider network of an insurer is relevant to the market power of providers and the insurer. The negotiation over rates–payments from the insurer to providers for their services–includes the possibility of exclusion from the network. For a sufficient rate of pay providers will want to be in the network to have access to the volume of patients the insurer can deliver. At the same time, the insurer is only willing to pay so much to a given provider: more for a dominant provider, less for a small player.

What distinguishes the provider network from other benefits is that it exerts a positive externality on policyholders. This type of inter-group network externality is the defining feature of a two-sided market. The greater the number of providers in an insurer’s network, the more a consumer will pay that insurer for access. All other things equal, consumers like access to more providers. They’ll pay a higher premium for such access.

This (two-sided) market-theoretic aspect of health care costs is not reflected in the figure above, nor is it reflected in most theoretical motivation or empirical specification of analysis of health care markets in the literature. This is not a surprise. The foundational work on this is brand new.