The following is from Information asymmetry and performance tilting in hospitals: a national empirical study by Wang et al. (Health Economics, 2010).

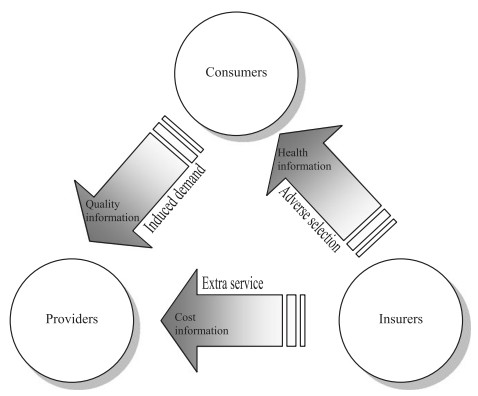

[A] hypothetical model of the interactions involved with the three main participants in the health services market, as well as the relative distributions of information between those participants, is visualized in Figure 1 [below]. In the pictorial model, the head of an arrow indicates the side where most of the information tends to reside and the tail of an arrow indicates comparatively low related information. For instance, providers tend to withhold service quality and cost information without ascertaining patients’ demands due to high transaction costs. Further, the model implies that asymmetric information distributions among the three participants of health-care services place health service providers in an advantageous position, while putting patients and insurers at a disadvantage. Purchasers of insurance are also unable to ascertain whether the prices charged by insurers for their service (risk re-allocation) are fair. Further, insurers use their market power to extract significant discounts from providers. […]

Asymmetric information may cause increased prices for health services (De Fraja, 2000), because it can bestow market power on the holder of superior information and permit the charging of monopoly prices.

What’s interesting here is that, according to the pictured conceptual model, insurers have the least information and providers the most. Yet, in our largely fee-for-service system, insurers are at most risk for costs and providers the least. This strikes me as totally wrong. Since information is (market, hence pricing) power, the best thing system reform could do is align risk with information. ACOs, for example, could do exactly this.