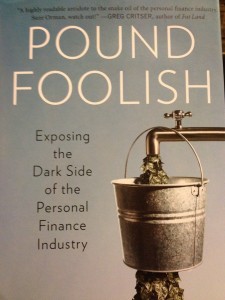

Here are the first two segments of my interview with Helaine Olen regarding her book, Pound Foolish. You can see a more extensive interview with Olen, with arguably better production values, on Frontline’s the retirement gamble this week.

Here are the first two segments of my interview with Helaine Olen regarding her book, Pound Foolish. You can see a more extensive interview with Olen, with arguably better production values, on Frontline’s the retirement gamble this week.

In Part 1, we discuss how she got into this game, what it was like to do the Money Makeover feature for the Los Angeles Times. As I nod to project the wisdom of a sage and swig diet soda, we discuss what I regard as the financial industry’s most basic dilemma: The best advice fits on a 3×5 index card and is available for free at the library.

We also discuss why divorce is bad for your financial health, and why trusting financial advisors is generally foolish, even if one assumes that this person is above ethical reproach. We note the false hopes placed in personal financial skills to offset stagnant wages for millions of Americans. Finally, we observe that Suze Orman isn’t one of the world’s greatest financial advisors. She has found one of the world’s greatest sales gigs. At least Orman is less predatory than many of the other finance gurus.

In Part II, we start to get into the meat of things. We start by discussing the dinners for senior citizens, at which entrepreneurs sell rip-off variable annuities to seniors desperately (often fairly realistically) afraid that they will outlive their savings. As a warm-up, these salespeople predictably trash Social Security—the one solid source of annuitized wealth that Americans can turn to in their retirement years. Here’s a link to Personal Finance for Dummies, which beats most more pretentious personal financial advice books around.

I’m cross-posting this with the Reality-based Community. I’m doing so to compare the comment threads on the two sites.