This is neither as entertaining as Kevin Drum’s Friday Cat Blogging nor as regular (nor always on Fridays), but here’s an update on my experience with solar. My home’s photo-voltaic system has been running for about three months now. Guess how much it has offset electric energy we’d otherwise have drawn from the grid?

We both know you’re not going to guess and that I’m going to tell you. So let’s cut the charade and get right to it.

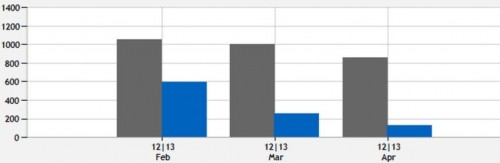

Here’s the graph, comparing last year’s draw from the grid (in kilowatt-hours, of course) to this year’s, by month. I admit, the offset is bigger than I thought it’d be.

The gray bars are last year, the blue this year. Our grid draw is going down as the days grow longer. By the April meter read, it was already nearly six times lower than last year. It shouldn’t be long now until we are generating more solar power than we use, which we’ll bank for the shorter solar days through net metering.

Pretty good, eh? Let me know if you want in on this action. A referral gets you a discount and me a credit.