After I posted the following chart from Charles Roehrig, readers emailed me with questions. Some I can answer. Some I cannot. The Q&A is below the chart.

Question: Does heath spending as a share of GDP only go up during and around recessions?

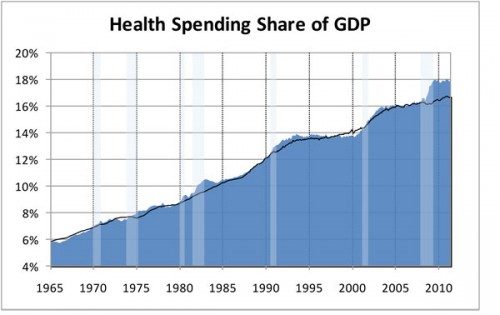

Answer: Not exactly, but it’s a good rule of thumb anyway. The figure above only goes back to 1990. If you go back farther, you see that health spending as a share of GDP grows between recessions too. The following figure is also from Charles Roehrig. Ignore the black line (follow the link for details). See how there is growth between the early 1980s and early 1990s recessions? However, what is true is that health spending as a fraction of GDP tends to have some flat spots between recessions and steep growth during and around them. That’s largely due to changes in the denominator, GDP. When GDP growth is lower, the ratio of spending to it is higher and vice versa.

Question: Why was health spending as a fraction of GDP flat during much of the 1990s?

Answer: Managed care kept health spending growth down and GDP growth was substantial. The combination of the two just happened to keep the ratio nearly constant.

Question: Why was health spending as a fraction of GDP flat in part of the 2000s?

Answer: GDP growth is part of the answer. But health spending growth was modest too. Nobody I’ve asked has a good explanation for it.

Question: What about other flat spots, prior to 1990, such as the one in the late 1970s?

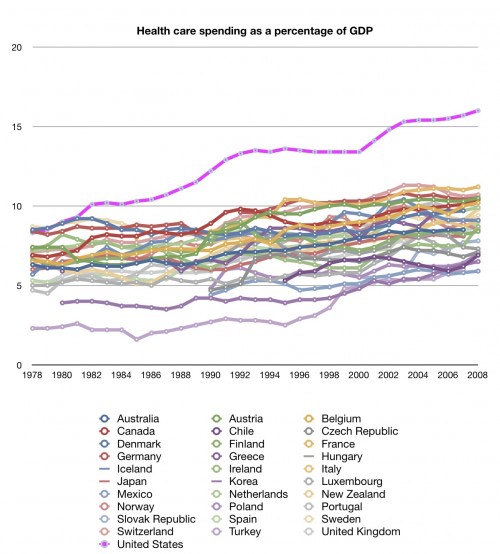

Answer: I don’t really know, but it is worth keeping in mind that our health system was very different before 1980. Prior to that year (or thereabouts), we had similar spending growth as other wealthy countries. Afterwards, the US pulled away from the pack. See:

Question: What are the implications for capping spending at GDP + 1 percentage point (or 0.5 percentage points or some other GDP-keyed target)?

Answer: This could be problematic during recessions. Health spending is relatively sticky. It’s rate of growth doesn’t necessarily fall when GDP falls, or not as much anyway. It’s clear from the charts above that during boom times, holding health spending growth to GDP + 1 (or something like that) is very doable. But, what happens when economic growth sags? Is it a good idea just to slash health spending?

What would be better is to permit health spending to go above the target (GDP + 1 or whatever) during recessions and insist that we make up for it when the economy recovers. This would spread the pain out more evenly, demanding that we tame health spending relative to GDP when it seems more feasible to do so.

Also, as health care becomes a larger fraction of the economy, its growth is more tightly correlated with overall GDP. After all, if the entire economy was health care then achieving a target health care growth rate no higher (or lower) than GDP would be trivial. We’d be living in caves, though.