You remember how Scott Brown’s win in the January 19, 2010 Massachusetts special election to fill the Senate seat vacated upon the death of Edward Kennedy seemed to doom health reform, right?

Well, it also presented an opportunity to assess whether health reform was good or bad for the health care industry. Mohamad Al-Ississ and Nolan Miller (ungated working paper version here) exploited it as a natural experiment.

If [Scott] Brown’s victory, which was largely unanticipated until shortly before the election, is associated with positive abnormal return to health care stocks, this suggests that markets interpreted Health Reform as harmful to the health care industry, and vice-versa in the case of a negative abnormal return.

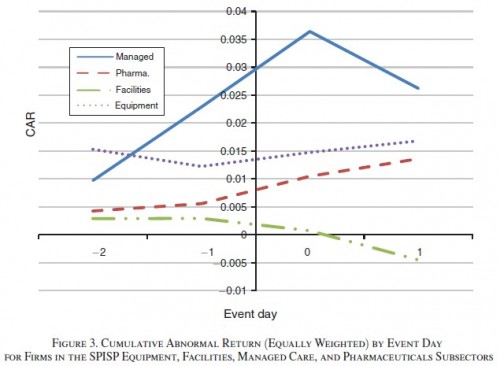

Using a regression-based event-study approach, we find that Brown’s victory induced a positive and significant overall effect on health care stocks. A typical dollar invested in the health care sector realized a 2.1 percent Cumulative Abnormal Return (CAR) between January 14, 2010 and January 20, 2010. Investments in pharmaceutical firms earned a CAR of 2.8 percent, and investments in managed care companies (i.e., health insurers) earned a CAR of 6 percent. Thus, the market appears to have judged Health Reform to be harmful to the health care industry overall and in particular to insurance and pharmaceutical firms. However, not all firms experienced gains following the election. In particular, we find that investments in health care facilities (e.g., hospitals) experienced abnormal losses of 3.5 percent following the election, consistent with the idea that Health Reform, which was expected to reduce the amount of uncompensated care hospitals were forced to provide, was good for the facilities subsector. [Hyperlink added.]

I’m not drawing or suggesting any normative conclusions from this. You can roll your own. The point is that health reform at least redistributed, if not contracted relative to trend, total spending within the health care sector. There were and will be winners and losers. That’s reflected in health industry firms’ stock returns. I cannot imagine any reform that doesn’t affect them in some way, and not all positively.