Many people want to know if they are eligible for premium tax credits for marketplace (exchange) plans. I’ve been asked this question numerous times and seen and heard it asked of others. The typical answer is that if you have coverage from an employer or public program, you are not eligible for tax credits.

That typical answer leaves one big thing out. Some people with employer-based coverage are eligible for tax credits. If that coverage is deemed unaffordable, tax credit eligibility is conferred. What’s unaffordable? That’s where it gets a bit complicated, especially when considering family coverage. And, the answer is a bit nonsensical in the case of family coverage due to what’s known as the “family glitch.”

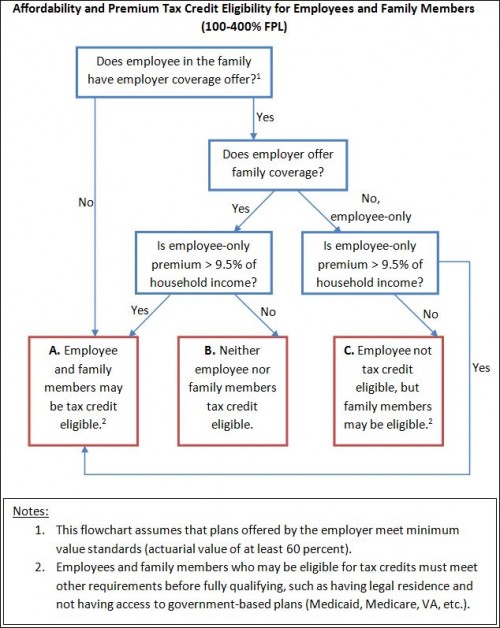

Let me explain … No, wait, let me not explain and instead turn it over to Josh Fangmeier, a health policy analyst based in Ann Arbor. He sent me the flow chart below that conveys exactly when an employed individual and his/her dependent family members are eligible for premium tax credits for exchange-based coverage.

No, the chart is not wrong in saying that a family member is not eligible for tax credits if employee-only (not employer-based family coverage) is affordable. Yes, you will be denied tax credits if employer-based family coverage is unaffordable by any measure, so long as employee-only coverage is affordable, as defined in the chart. This is the family glitch. It’s in the law. And it would take an act of Congress to fix.

The chart should cover the vast majority of cases and questions, but there are a few details it leaves out. One, for example, is that “household income” is modified adjusted gross income. (Look it up.) As evidence that this is indeed tricky, it took Josh and me a day of back-and-forth emails to fine tune the chart for clarity and focus. We did cut some specifics to make it maximally accessible and clear. So, please pose other, nuanced questions you have that the chart doesn’t address in the comments.

The chart is also available in this PDF. And here is the employer coverage tool (form) that lists the employer-sponsored coverage related information you will need to provide to apply for exchange plan tax credits.