Like it or not, the ACA will be judged, at least in part, by the degree to which it contributes toward reducing the rate of growth in health care spending. There are reasons to be optimistic that the law will help to “bend the cost curve”: as Henry Aaron put it, the ACA contains “virtually every idea for cost control that any analyst has come up with.”

There are reasons for pessimism too: the success of the law depends on the body that has the power to destroy it, Congress. If Congress is unified, or reasonably so, in preserving and strengthening the cost control mechanisms in the law, the chance they will work increases considerably. If, however, Congress, or even a significant minority of its members, wants to delay, weaken, or repeal components of the law, success in cost control is far less likely. It’s no insignificant point that the law may be declared a failure by the very individuals who fought to undermine it. Would that really be a failure of the law?

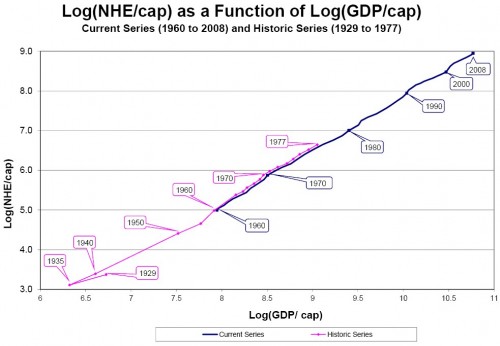

If, by action of politicians or the market, the health care spending curve is not bent, one might argue that this reflects our collective desire, our revealed preference. The history of health care spending in the US is consistent with the hypothesis that we view health care as a luxury good, one on which we spend more of our wealth as that wealth grows. A new paper in Health Economics by Robert Woodward and Le Wang, titled The Oh-So Straight and Narrow Path: Can the Health Care Expenditure Curve Be Bent?, illustrates that point (see their chart below). The great question Woodward’s and Wang’s paper suggests to me is that if health is a luxury good, why should we expect the health spending trajectory to change?

The chart shows that on a log-log scale, the relationship between per capita national health expenditures and per capita GDP is ram-rod straight and has been since 1935.* Based on several statistical tests, Woodward and Wang conclude that there are

no significant changes in either the intercept or the slope for the years of any of the major reforms of the period, including the introduction of Medicare and Medicaid in 1966, in the years following Nixon’s Wage and Price Controls and the health planning legislation of the early 1970s, in the years following Medicare’s introduction of the Prospective Payment System in 1984, or after the widespread adoption of managed care in the 1990s.

With such overwhelming evidence from our past that, despite our efforts, this national health spending curve has not bent, why do we think the future will be much different? It is not unreasonable to think it will not be. But, if we presume the curve will not be bent, what then are reforms able to do? I think the answer is twofold. One is that they might shift the level of spending, but not the rate of growth. If the level is shifted gradually over time it will appear as if the growth rate has changed. The long view is likely to show that it has not.

The other thing reform could do is change what we receive for our spending. If observable measures of population health change through the change in payment incentives without a change in spending, reform advocates will still claim victory, as they should. In a narrow sense, this is a bending of the curve–the “cost per quality” one. Spending more of our wealth to confer better care on more people is not without value.

Woodward and Wang note that we may be receiving other things for our additional spending: “hope, uncertainty‐reducing information, and amenities.” None of these may actually improve health, but they are still valued consumption components of health care. In other words, the view that health care is entirely an investment in health is, perhaps, too narrow. We may rationally value additional spending on it if, by doing so, we buy hope, peace of mind, and other comforts that we value more than the dollars they consume.

Politics and entrenched interests have a lot to do with how health care dollars are spent. But, as Woodward and Wang suggest, so does the fact that we have come to expect more for our health care dollar (or someone else’s) than just health. Bending the curve will require breaking our expectations. So far, I have not seen good evidence that we are willing to accept what that means.

* The authors sent me this figure, which, due to an error in the publication process, is not the one in their paper but is the one that should have appeared there. There is no qualitative difference between the two figures or the conclusions drawn from them. (I think the only difference is axis labeling.)

UPDATE: Revised figure from authors.