The following is a slightly edited excerpt from the working paper version of my paper “How much do hospitals cost shift? A review of the evidence,” to appear in issue 1, volume 89 of The Milbank Quarterly (expected March 2011). See also “Estimating Hospital Cost Shift Rates:A Practitioners’ Guide“.

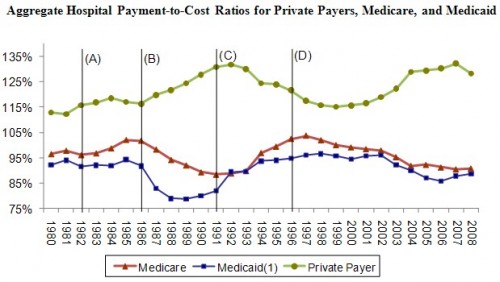

Yesterday, I concluded a post on cost shifting (which you should read for the very definition of “cost shifting”) with this figure, promising to explain it further today. (Figure sources: AHA (2003, 2010)).

Much of the commentary in the literature pertaining to public and private payments to hospitals and their relationship references time series such as those depicted in the figure (see, for example, Mayes and Hurley 2006; Mayes 2004; Dobson, DaVanzo, and Sen 2006; Lee al. 2003; Zwanziger and Bamezei 2006). Except, perhaps, over the period 1980-1985, the private payment-to-cost ratio is negatively correlated with those of public programs. This is suggestive of cost shifting, but other hypotheses are consistent with the evidence; it may be coincidental or driven by other factors. As suggested in the subsections that follow, much of it may be explained by changes in hospital costs and hospital or plan price setting power due to market size, reputation, and other factors relating to “market clout.”

In the figure, the years 1980-2008 are broken into five spans of time by four lines marked (A) through (D). These five eras correspond to periods over which health care market structure (hospital and plan market power) and policy landscape had distinct characteristics. Those characteristics changed at each of the demarked boundaries by identifiable legislative or market events. In the subsections that follow, I describe those eras and events, focusing on Medicare policy and payment changes. Medicaid payment in relationship to costs tends to track Medicare payments as can be seen in the figure.

The Golden Stream (before 1983)

Policymakers have struggled with Medicare financing since the early years of the program. The original hospital payment design reimbursed hospitals retrospectively for all services at their reported costs plus 2% for for-profits and plus 1.5% for non-profits (Weiner 1977). These so-called “return on capital” payments were eliminated in 1969 (U.S. Senate 1970). The cost reimbursement system that replaced them included a so-called “nursing differential” that paid hospitals an additional 8.5% above inpatient nursing costs (Kinkead 1984). The 8.5% nursing differential was reduced to 5% in 1981 (SSA 1983) and eliminated altogether by 1984 (Inzinga 1984). Thus, from the inception of the program into the 1980s hospitals could earn greater Medicare revenue and profit simply by increasing reported costs or a portion thereof (inpatient nursing costs in the case of the nursing differential) (Mayes 2004). With no incentives for cost containment by hospitals, the system was described as “a license to spend, … a golden stream, more than doubling between 1970 and 1975, and doubling again by 1980” Stevens (1989).

Meanwhile, indemnity plans were the norm in the private sector. Without the leverage of network-based contracting (in which some providers could be excluded) and with payment rendered retrospectively on a fee-for-service basis, no successful cost controls existed in the private sector either. Managed care was unheard of until 1982. In that year California passed a law that allowed health insurance plans to selectively contract with hospitals, a statute that was widely emulated elsewhere sowing the seeds for the cost control role played by managed care in the 1990s (Bamezai et al. 1999).

Thus, prior to 1983 (the period up to line (A) in the figure), attempts by public and private payers to control hospital costs were largely unsuccessful. In general, both rose over time, consistent with the positive correlation between the two that persisted until about 1985 and evident in the figure. In the relationship between hospitals and their payers, hospitals had the lion’s share of power. Price competition did not exist and hospitals attracted physicians and patients with costly, non-price amenities and services (Bamezai et al. 1999).

Incentive Reversal (1983-1987)

With a goal of reducing domestic spending, the Reagan Administration targeted Medicare hospital payments. Then Health and Human Services Secretary Richard Schweiker became enamored of New Jersey’s hospital prospective payment model, based on diagnosis-related groups (DRGs), and developed Medicare’s system accordingly (Mayes 2004). Under Medicare’s prospective payment system (PPS), implemented in 1983, each hospital admission was assigned to one of almost 500 DRGs, each of which was associated with a weight based on average costs of treating patients in that DRG in prior years. The payment to a hospital for an admission was the product of the DRG weight and a conversion factor. Medicare could (and did) control the amount of payments to hospitals by adjusting the growth rate of the conversion factor and/or adjusting the relative DRG weights (Cutler 1998).

The critical element of the PPS is that prices were set in advance of admissions (i.e., prospectively), putting hospitals—not Medicare—at financial risk for the cost of an admission. Rather than paying hospitals more if they did more, as the prior system had, the PPS encouraged them to do less, and pocket any surpluses of prices over costs. The reversal of incentives was designed to control costs and the conversion factor and DRG weights were the policy levers for doing just that.

The PPS phased in over four years. Hospitals quickly learned how to reduce lengths of stay and, thereby, costs. Since PPS payments were based on historical costs, the early years saw a spike in aggregate payment-to-cost ratios, evident in Figure 1 (Coulam and Gaumer 1991).

Medicare, Congress’s Cash Cow (1987-1992)

By 1987 (after line (B) in the figure), the PPS was fully phased in and Congress began using its policy levers to extract huge savings from Medicare and apply them to deficit reduction. The legislative mechanism was the annual budget reconciliation process. Robert Reischauer, Congressional Budget Office director from 1989-1995, explained how the PPS was viewed and used by Congress:

Medicare was the cash cow! […] Congress could get credited for deficit reduction without directly imposing a sacrifice on the public. . . . And to the extent that the reduction actually led to a true reduction in Medicare services, it would be difficult to trace back to the Medicare program or to political decision-makers. (Mayes 2004)

Aggregate Medicare hospital payment-to-cost ratios fell every year from 1987-1992 because hospital did not restrain costs as quickly as payments were adjusted (Guterman, Ashby, and Greene 1996). As Medicare margins fell, private pay margins grew over this period. The effects of managed care had not yet been fully felt in the commercial market, leaving private purchasers vulnerable to hospitals’ market power. If ever there was an era during which the market conditions were ripe for cost shifting, this was it.

Key to the ability for hospitals to shift costs during the 1986-1992 period was their (as of then unexploited) strong market power relative to that of private plans. But the balance of power was about to change, severely attenuating the ability to shift costs. I’ll pick up the story there in tomorrow’s post.

References

AHA (American Hospital Association). 2010. Trendwatch Chartbook 2010: Trends Affecting Hospitals and Health Systems.

AHA (American Hospital Association). 2003. Trendwatch Chartbook 2003: Trends Affecting Hospitals and Health Systems.

Bamezai A, Zwanziger J, Melnick G, Mann J. 1999. Price competition and hospital cost growth in the United States (1989-1994). Health Economics 8(3):233-243.

Coulam R, and Gaumer G. 1991. Medicare’s prospective payment system: a critical appraisal. Health Care Financ Rev Annu Suppl. pp. 45-77.

Cutler D. 1998. Cost Shifting or Cost Cutting? The Incidence of Reductions in Medicare Payments. Tax Policy and the Economy 12:1-27.

Dobson A, DaVanzo J, and Sen N. 2006. The Cost-Shift Payment ‘Hydraulic’: Foundation, History, and Implications. Health Affairs 25(1): 22-33.

Guterman S, Ashby J, and Greene T. 1996. Hospital Cost Growth Down: Unprecedented Cost Constraint by Hospitals Has Maintained Their Bottom Line. But Can It Continue? Health Affairs 15.

Inzinga M. 1984. Legislative Issues and Health Care Trends–Quality Assurance. Nursing Administration Quarterly 8(4):80-84.

Kinkead B. 1984. Medicare payment and hospital capital: the evolution of policy. Health Affairs 3(3): 49-74.

Lee J, Berenson R, Mayes R, and Gauthier A. 2003. Medicare Payment Policy: Does Cost Shifting Matter? Health Affairs. October.

Mayes R. 2004. Causal Chains and Cost Shifting: How Medicare’s Rescue Inadvertently Triggered the Managed-Care Revolution. Journal of Policy History 16:144-174.

Mayes R and Hurley R. 2006. Pursuing cost containment in a pluralistic payer environment: from the aftermath of Clinton’s failure at health care reform to the Balanced Budget Act of 1997. Health Economics, Policy and Law 1:237–261.

SSA (Social Security Administration). 1983. Summary of 1982 Legislation Affecting SSI, OASDI, and Medicare, Social Security Bulleting 46(7). July.

U.S. Senate. 1970. Medicare and Medicaid: Problems, Issues and Alternatives. Report of the Staff to the Committee on Finance. Committee Print, 91st Congress, 1st Session. Washington, DC: U.S. Government Printing Office.

Weiner S. 1977. Reasonable Cost Reimbursement for Inpatient Hospital Services Under Medicare and Medicaid: The Emergence of Public Control. American Journal of Law & Medicine 3(1):1-47.

Zwanziger J and Bamezei A. 2006. Evidence of cost shifting in California hospitals. Health Affairs 15(1).