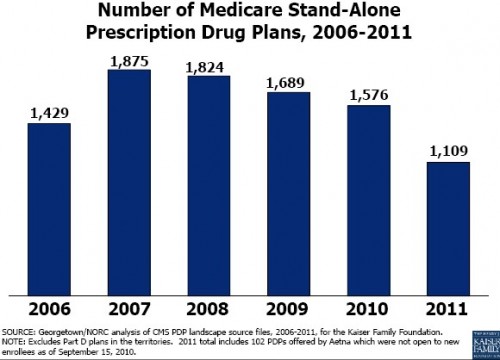

This is interesting: the number of Medicare stand-alone prescription drug plans (PDPs) has been dropping. According to a new report from the Kaiser Family Foundation, there will be 30% fewer PDPs in 2011 as there are today. Once upon a time, all beneficiaries had access to about 50 PDPs. No longer.

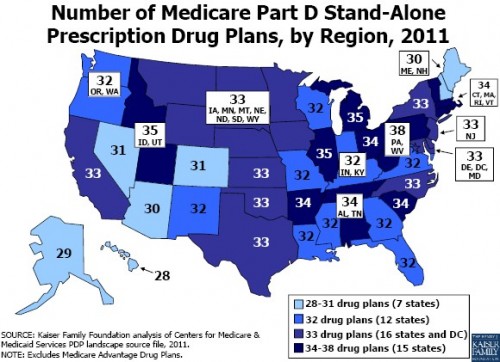

Here’s a map.

What’s the story here? Which plans from which firms are withdrawing? Is this market predation? Are the dominant firms gaining market share and driving rivals out? The KFF report sheds a little light:

The reduction in offerings results from recent regulations issued by CMS intended to eliminate duplicative plan offerings and plans with low enrollment.

Most of the plan reductions result from plan sponsors reducing the number of separate PDP offerings (some resulting from mergers among sponsors). Nine of 16 national PDP sponsors dropped at least one of their 2010 PDP offerings.

With 30+ plans to choose from it still seems like there’s plenty of competition in this market. Yet premiums are expected to go up 10% in 2011. Are the plans to blame for this? Or is it drug costs? The report says, “[The] increase reported here incorporates higher premiums for enhanced coverage offered by nearly half of all PDPs.” That is, beneficiaries are selecting more generous plans and it’s the prices of those plans that are driving the increase in average premium.

This is all descriptive. But it does suggest that one must be careful when looking at data. The reduction in number of PDPs and increase in premiums may not have anything to do with market power and consolidation or “greedy” insurance companies (or drug manufacturers). It could be (and likely is in large part) regulation and choice, as the KFF report suggests.