I wrote about a cost sharing research review paper by Katherine Swartz earlier today. Another one is out, by Katherine Baicker and Dana Goldman. Like Swartz’s paper, Baicker’s and Goldman’s is ungated and quite readable. Here’s the abstract:

In this paper, we explore the role patient incentives play in slowing healthcare spending growth. Evidence suggests that while patients do indeed respond to financial incentives, cost-sharing does not uniformly improve value; rather, cost-sharing provisions must be deliberately structured and targeted to reduce care of low marginal value. Other mechanisms may be helpful in targeting particular populations or types of utilization. The spillover effects between privately insured and publicly insured populations as well as market imperfections suggest a potential role for public policy in promoting insurance design that slows spending growth while increasing the health that each dollar buys.

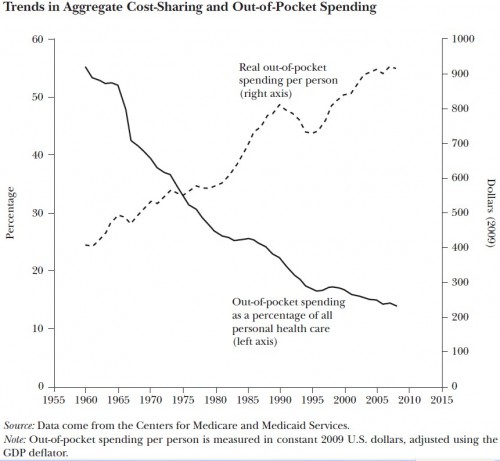

What I really want to get to, though, are two figures. The first combines two frequently cited trends on cost sharing. Has cost sharing gone up or down? It depends whether you consider absolute or relative spending. See:

Out-of-pocket spending as a percent of all personal health care spending has gone down (sold line, left-hand axis). However, real OOP spending has gone up in absolute terms (dashed line, right-hand axis). If you think about it, this is telling us that overall health care spending is going up very rapidly. Deductibles and copayments are going up too, but not as fast, in general. (Changes in the absolute and relative number of uninsured matter too, as do patterns and volume of utilization.)

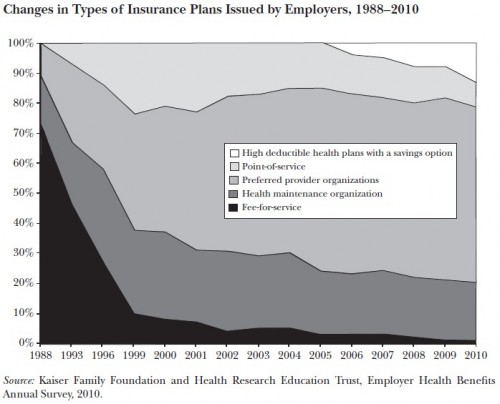

The next figure illustrates the evolution of employer-sponsored health insurance, by plan type. What the authors call “fee-for-service” plans are what most others term “indemnity” plans. Most of the recent growth has been in high-deductible health plans (HDHPs). No surprise there. Still, HDHPs are a relatively small portion of the overall commercial market.

HDHPs, of course, increase patient cost-sharing, certainly in absolute terms. Now go back to the first graph. Is cost-sharing going up in absolute terms? Check. Is it going up in relative terms? No. Again, that’s because overall health care spending is rising very quickly. (I’m not suggesting all the recent spending dynamics are due to HDHPs. They’re just one part of the picture.)

Will more HDHPs and enrollment in them change the spending trajectory? Of course, we don’t know. That’s my earlier post. However, we thought that our prior innovations would change things too. They didn’t, not in the long-run anyway.

UPDATE: Fixed minor bits of logic.