New paper in Health Affairs: “More Than Half Of Individual Health Plans Offer Coverage That Falls Short Of What Can Be Sold Through Exchanges As Of 2014“:

The Affordable Care Act creates state-based health exchanges that will begin acting as a market place for health insurance plans and consumers in 2014. This paper compares the financial protection offered by today’s group and individual plans with the standards that will apply to insurance sold in state-based exchanges. Some states may apply these standards to all health insurance sold within the state. More than half of Americans who had individual insurance in 2010 were enrolled in plans that would not qualify as providing essential coverage under the rules of the exchanges in 2014. These people were enrolled in plans with an actuarial value below 60 percent, which means that the plans covered less than that proportion of the enrollees’ health expenses. Many of today’s individual health plans are below the “bronze” level, the lowest level of plan that can be sold through exchanges. In contrast, most group plans in 2010 had an actuarial benefit of 80–89 percent and would qualify as highly rated “gold” plans in the exchanges. To sell to ten million new buyers on the exchanges, insurers will need to redesign benefit packages. Combined with a ban on medical underwriting, the individual insurance market in a post–health reform world will sharply contrast with the market of past decades.

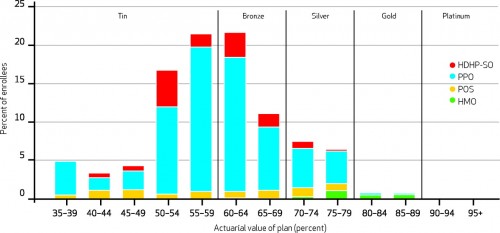

There are two figures in the paper, and both are worth looking at. Here’s the first, describing the actuarial values of individual plans:

As you can see, a ton of them fall below what would be considered “bronze” under the ACA’s exchanges. This means that all of those plans would have to be significantly improved if they want to be offered in the future. This is what I mean when I say that many people in the US are “underinsured”. It also means that the majority of people with individual policies are going to see a nice improvement come 2014.

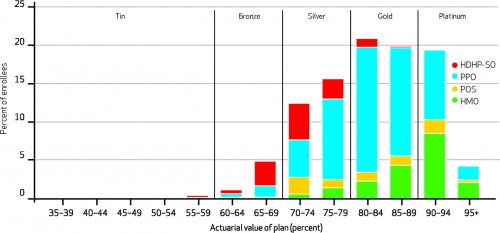

On the flip side, here are the actuarial values of group policies, or those likely to be offered by employers:

About two-thirds of employees have policies that would qualify as gold or platinum. That’s great for them now. But if employers decide in the future to go to the exchanges for their employees’ plans, many will likely choose to go with cheaper options, such as silver or bronze. Should that happen, many employees will find their out of pocket health care costs rising in 2014.

It’s likely that these two messages will allow for differing interpretations of the results of this study. Those who support the ACA will likely cite the first figure, pointing out how bad things are and showing how much things will be improved for those in the individual market. Those who oppose the ACA will likely cite the second figure, contending that those who already have insurance through their jobs may see a drop in the quality of their insurance coverage. Both may be right.

But let’s not forget how bad things are right now. This is from the Discussion of the manuscript:

Third, very sick patients—those in the top 1 percent of medical spending—incur sizable out-of-pocket expenses regardless of coverage. For example, these top spenders face out-of-pocket expenses of nearly $3,800 in a group platinum plan. But there are substantial differences in out-of-pocket spending between plans with high actuarial value and plans with low value. A family in the top 1 percent of medical spenders with tin coverage in the individual market incurs annual out-of-pocket expenses of more than $27,000.

The health care system is supposed to be for sick people. It’s currently failing them. If you’re lucky enough to have the best insurance in the country, getting really sick can cost thousands of dollars a year. If, however, you have crappy insurance, then getting sick can bankrupt you. If you’re among the tens of millions of Americans who are completely uninsured, you’re likely completely screwed.

Whether you love or hate the ACA, the status quo is terrible.