I haven’t hurt this much since I was forced to read the PPACA. But I’m willing to suffer for all of you.

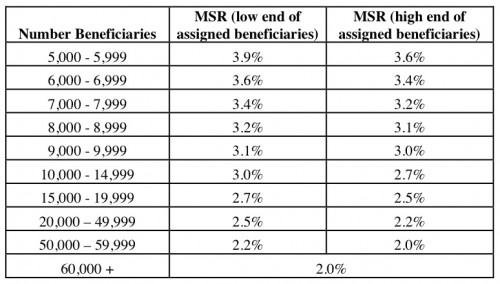

One of the questions I’ve always had is how much would an ACO make in incentive for succeeding in reducing costs. Let’s start with the one-sided model (which is all carrot). Section II.F. Shared Savings Determination makes thinks a bit more clear. First, a Minimum Savings Rate is established for an ACO based on its size (page 269):

The MSR is a percentage of a benchmark spending number that is calculated based on a whole host of factors for the individual ACO. Once this savings rate is achieved, then an ACO can get up to one half of the savings achieved (based on quality performance). The rule-makers considered three methods to do this.

The MSR is a percentage of a benchmark spending number that is calculated based on a whole host of factors for the individual ACO. Once this savings rate is achieved, then an ACO can get up to one half of the savings achieved (based on quality performance). The rule-makers considered three methods to do this.

1) The first option would permit an ACO to share on first dollar (or all) savings once the MSR was reached. This would maximize the an ACO’s potential reward. This be better for ACOs that serve a smaller population, which may be physician only, which predominantly care for underserved populations,or those in rural areas. However, it’s possible that sharing on first dollar could reward unearned savings due to natural variation instead of real savings achieved real redesigned care processes.

2) A second option would limit the amount of savings shared by an ACO only those in excess of the MSR. This would make it more likely that any shared savings were due to actual changes care processes as opposed to normal variations in spending. This option would also serve as an incentive for ACOs to work to generate greater levels of savings.

3) The third option is a hybrid of the other two. All ACOs would need to exceed the MSR to be eligible for savings, but they would share in savings in excess of a an individualized threshold. Some ACOs would be allowed to share in first dollar savings; others would not. This would help to make sure that savings were not due to normal variation, but also provide critical support for under-funded ACOs such as those listed in (1).

The rule-makers recommend (3). They also recommend that the threshold for savings be set at 2% once the MLR is met, unless certain exemptions apply. These include (pages 272-273):

- ACOs with less than 10,000 assigned beneficiaries in the most recent year for which we have complete claims data (for instance, 2012 for 2014 program participation) and that meet one of the following:

- The ACO is comprised only of ACO professionals in group practice arrangements or networks of individual practices of ACO professionals.

- 75 percent or more of the ACO’s assigned beneficiaries reside in counties outside a Metropolitan Statistical Area (MSA) in the most recent year for which we have complete claims data.CMS-1345-P 273

- 50 percent or more of the ACO’s assigned beneficiaries were assigned to the ACO on the basis of primary care services received from a Method II CAH.

- 50 percent or more of the beneficiaries assigned to the ACO had at least one encounter with an ACO participant FQHC and/or RHC in the most recent year for which we have complete claims data, that is, the ACO has met criteria for receiving full potential additional payment as described later in this proposed rule.

Next up, the two-sided model.