Eline van den Broek-Altenburg, PhD, has served as a health policy advisor in the Dutch and European parliaments and is currently an assistant professor at the Larner College of Medicine at the University of Vermont. Twitter: @E_line

Adam Atherly, PhD, is a professor and director of the Center for Health Services Research at the Larner College of Medicine at the University of Vermont. Twitter: @AdamAtherly

As the COVID-19 pandemic progresses, questions about reopening the economy are becoming increasingly paramount, as are questions about the relative costs and benefits of the shutdown. We made an early estimate of the relative cost effectiveness of the shutdown; we’re now revisiting the question to see if new data can provide new insights. (See our prior post for methodological background.)

Recalculate the Gains

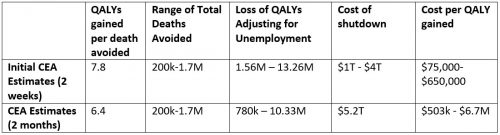

New work has provided more accurate estimates of the quality-adjusted life years gained (QALYs) from the shutdown. In our earlier calculations, we used diabetes as a reasonable proxy for many chronic diseases, but more recent work done by others has provided more precise corrections for multimorbidity. These and other estimates suggest a reasonable number of life years lost per person who dies is 11.0, QALYs lost per death is 8.1 and discounted QALYs lost is 6.4. This is slightly lower than our initial estimate of 7.8.

In our initial work, we did not include reductions in QALYs due to the health impact of unemployment. Although unemployment reduces individual health in a multitude of ways, the individual effect isn’t large and is somewhat controversial; one recent estimate suggests a reduction 0.1 QALY per year of unemployment. Currently, there are 30 million people unemployed due to the shutdown, which suggests 250 thousand QALYs lost per month. This should be subtracted from the health gains.

There are a couple of other health costs that are becoming evident, but are not yet quantifiable. Loss of health due to care delays because of the shutdown of the healthcare system to all elective procedures is likely of important magnitude, but reliable estimates are not yet available.

There are also now reports of increases in domestic violence and child abuse and neglect. This likely relates to a predictable decline in mental health. None of these are easy to quantify yet, but they may be of a meaningful magnitude and offset gains in life years due to reduced COVID-19 deaths from shutdowns.

The question remains how many deaths the shutdown prevents. This is currently the hardest number to estimate. We use the previously reported upper and lower bounds from 200,000 to 1.7 million people suggested by a CDC scenario analysis. This implies the pandemic, if unchecked, will lead to a loss of between 1.28 million and 10.88 million QALYs. If we subtract a two-month estimate of QALYs lost due to unemployment, the net gain becomes 780k to 10.33 million QALYs, not including life years lost due to delayed care, increased mental health problems and domestic violence. The updated numbers can be found in the table below.

Recalculate the Costs

One of the key changes to our initial calculation is that the cost of the shutdown is much greater than we initially estimated. We used $1T – $4T as the cost of the shutdown, following the cost of relief packages that were being debated at the time. This number largely reflected forgone productive activity that didn’t happen due to the shutdown. Clearly that was a gross underestimate. An article in the Wall Street Journal suggested the economic cost of the shutdown is equal to 50% of monthly economic output, or about $900B per month. But there are two elements to the direct cost — the first is simply economic activity that would have happened but didn’t because of the shutdown — the $900B number.

The second is the cost of businesses that fail. If an extension of the shutdown leads to business failures, part of the cost of the extension is the net present value of the stream of production that would have been provided by those businesses that failed due to the shutdown. This cost is harder to quantify. A recent Goldman Sachs survey found that 51% of small businesses will fail within 12 weeks after the shutdown begins. If we assume a linear failure function and calculate the net present value of the stream of lost productivity of small business failures, costs grow exponentially as the shutdown continues. The total cost of both forgone productivity and business failure would be $1.5T for the first month and rises to $3.4T after two months. Add two months of $900B loss of economic activity for a total loss of $5.2T.

But what is the counterfactual? That is, what would have happened to the United States economy if there hadn’t been a shutdown. Sweden didn’t fully shut down their economy as did most other countries. Yet Sweden is also in recession, both due to the limited measures they did engage in and due to economic losses related to the global economic slowdown. However, in previous pandemics, like 1968, the economy was not shut down and there was no recession. How modern consumers would have reacted in the face of a highly publicized pandemic without a government response is unknown. The restaurants in Stockholm were reportedly packed at the height of the crisis; how American consumers and restaurant goers would have acted is unknowable. In our estimates, we assume no consumer reaction to the pandemic.

We didn’t include healthcare costs in our estimates. The cost per hospitalization for COVID-19 has been estimated at $64,000. The number of US corona-related hospitalizations was 130,000 by this week, so that would add a cost of $8.3B. But hospitalizations that occur happen with or without the shutdown and difference out of the equation. Any hospitalizations avoided due to the shutdown should be subtracted from the net cost. This number is unknown and unlikely to be on a meaningful order of magnitude.

A New Estimate

The table below summarizes the previous calculations and current updates. Our revisited analysis shows that, as the shutdown continues, the cost per QALY gained increases exponentially due to the exponential growth in the total cost of both forgone productivity and business failure.

We previously emphasized that a key challenge in making calculations of this type is the uncertainty around the data inputs. Six weeks later, this still holds true, particularly for the range of QALY losses without a shutdown, i.e. the predicted corona-related deaths in the absence of intervention.

One interesting aspect of this analysis is that as time goes on, the cost per QALY gained will become higher and higher. This is because the net gains will diminish — the lives saved remains constant, but the offsetting life years lost due to other factors increase — while the costs increase exponentially. The key number that remains unknown is the relationship between the length of the lockdown and the number of lives lost.

In our first post, we concluded that the shutdown would meet conventional standards of cost effectiveness only if the deaths avoided was on the high end of the possible range and the costs on the low end — an outcome that seemed unlikely. Revisiting the issue, it is now clear that the cost per QALY gained from the shutdown will be outside the conventional range of acceptability even at the high end of deaths avoided. How far outside the range the shutdown policy will ultimately prove to be is unknown.

Update: There has been quite a bit of pushback on our comment that “In our estimates, we assume no consumer reaction to the pandemic”. We’ll briefly explain our thinking.

This second blog was intended as an update to our earlier piece and was written to be comparable to our earlier estimates. We maintained consistency throughout to just focus on changing numbers rather than changing methods. If we were to change methodology, for example, we would have been more likely to change the underlying assumptions about the range of plausible deaths. The high end of predicted deaths due to COVID-19, based on CDC scenario analysis (1.7m deaths without an intervention), in retrospect seems unrealistic.

But, addressing the consumer question directly, we are unsure to what extent there will be a consumer reaction. This will depend on a number of factors. One is consumers’ perceived risk, which is unknown. We observe anecdotally the news that Swedish authorities needed to close some bars and restaurants because of failure to adhere to guidelines. This suggests that the guidelines are binding on some consumers – that is, the guidelines force some proportion of consumers to act in ways they would not without the guidelines. Similarly, we can observe that the unemployment rate in South Dakota, which famously didn’t enact any shutdowns, is currently only 6%. However, we’d be very cautious about drawing broad lessons from either South Dakota or Sweden to the rest of the United States. We also noted that neither of the last two pandemics in the 20th century caused large consumer reactions. Drawing conclusions from either 1968, during the height of the Vietnam war, or 1957 during the height of the Cold War, seems even more implausible. Particularly, consumer reactions may be different in the modern media era – whether today’s media is better or worse is immaterial – the key is that it’s different than 1968 / 1957 and thus reactions and perceptions of risk by consumers will also be different.

One way to get at the consumer reaction would be to do a thought exercise of how large the consumer reaction would need to be to move the shutdown into a cost-effective range, using convention CE standards. At the high end of 1.7m deaths (a now apparently implausible estimate), we calculated that the “value” of the lives saved would be about $1T using expected QALYs gained and $100,000 per life year. If the cost of the shutdown is $5.4T, it would be necessary for a consumer reaction to the threat of the virus to be 80% (1:5) of the effect of the government rules. In other words: the consumer response to the crisis, in absence of government response, would need to be a spontaneous reduction in spending of $4.4T. At the low end of the deaths, the consumer response would need to be more than 95% of the reaction to the government rules.

If this is correct, then the shutdowns are unnecessary because consumer behavior would have been largely the same with or without government intervention. This seems implausible.