Thomas Edsall in The New York Times:

the Affordable Care Act can be construed as a transfer of benefits from Medicare, which serves an overwhelmingly white population of the elderly – 77 percent of recipients are white — to Obamacare, which will serve a population that is 54.7 percent minority. Over 10 years, the Affordable Care Act cuts $455 billion from the Medicare budget in order to help pay for Obamacare.

Those who think that a critical mass of white voters has moved past its resistance to programs shifting tax dollars and other resources from the middle class to poorer minorities merely need to look at the election of 2010, which demonstrated how readily this resistance can be used politically.

Please let me know whether you agree with Edsall’s numbers. Regardless, he captures an essential political reality.

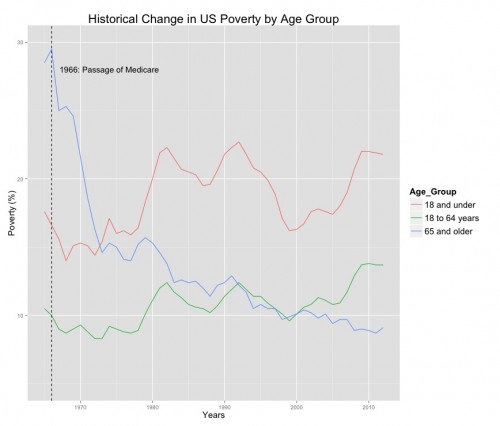

A small irony here. The current American elderly cohort is relatively prosperous and has secure access to health care. This is the result of the great progressive victories of the mid-twentieth century: the expansion of Social Security benefits, Medicaid, and above all Medicare.

Fifty years ago, the elderly were far and away the poorest of Americans. Today they are not and that is because sometimes government really does work.