One of the largest purchases I’ll make in my life is buying college educations for my children. So, I’m paying close attention to how I save, and how much I need to save, for that expense. Last year and earlier this year I went pretty deep into this issue. (To benefit from my research and save yourself some time, see posts under the “saving for college” tag.)

One thing I discussed in a prior post was that you shouldn’t expect to pay the “sticker price.” A lot of students receive grant aid. The rub is you don’t know exactly how much aid you’ll get. But we do know a lot about the average level of aid. That’s described in excruciating detail in a recent report from the College Board on tuition discounting.

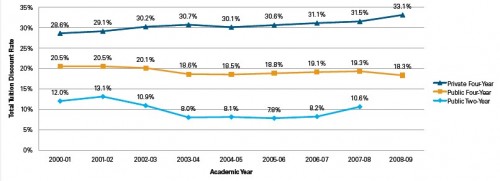

From it, we learn that average discounts are above 30% at four-year private institutions and the discount rate has grown over the past decade.

Tuition discount rate by sector

The report also tells us,

Because of growth in total grant aid, net prices have risen more slowly over time than have published prices. In the public two-year and public four-year sectors, estimated average net tuition and fees in 2009-10 are lower than those in 1999-2000 after adjusting for inflation. In the private four-year sector, estimated average net tuition and fees in 2009-10 are about the same as those in 1999-2000.

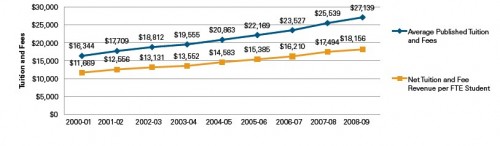

Average published tuition and fees and net tuition and fees per FTE student at private four-year institutions

It’s very nice that there is some hope of slightly lower than astronomical tuition bills for my children. But it’s still very frustrating not to have a good sense of what those bills will be. But, as I wrote before, I couldn’t possibly save enough to fully pay private four-year tuition rates anyway. What I can do is save to meet my expected family contribution (EFC). That doesn’t change much over time unless your income and assets change.

Of course, only being able to save for my EFC means my kids could be in for a lot of debt if they attend a school that costs a lot more than that net whatever tuition discount they receive. Maybe I can steer them toward something more affordable. Maybe not. Either way, it’s a problem for another time. I’ve got over a decade to think about it. And, believe me, between now and then I’ve got far more pressing childhood issues to consider.

(For instance, one recent problem was how to get vomit smell out of a carpet, even after it’s been cleaned many times with the usual stuff you’d think to try. Know the answer? There are lots online, but my sister-in-law knows how to do it in seconds, and now I do too. If nobody gets it I’ll post later in the comments to this post. Lemme here your answers first. By the way, this could come in handy at college too, so it really does belong in this post.)