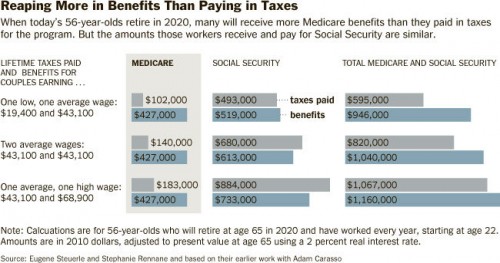

As blogging goes, this is old news. In an article last week, David Leonhardt included the following graphic.

We knew this already. Across a fairly wide range of incomes, one receives something close to what one contributes toward Social Security. Across all incomes, one receives vastly more than one contributes to Medicare. Why the difference? Two reasons: (1) Much of Medicare is not funded by earmarked payroll tax, though all of Social Security is. (2) Health care costs rise much faster than income. Hence, even the portion of Medicare intended to be funded by payroll tax is a vastly larger sum by the time an individual retires then it would have been during much of his or her working years.

This puts a lot of focus on earmarked payroll taxes. Other than for psychological or political reasons, there’s no strong justification to fund either Medicare or Social Security that way. General income tax, which is more progressive, is arguably more equitable. In other words, I don’t find the fact that people get more than they pay for by earmarked taxes in Medicare but they largely do get what they put in for Social Security a big deal in and of itself. It’s only a big deal to the extent that health care cost inflation is a big deal. And that is a big deal.

But we already knew that.