Leemore Dafny, with colleagues Mark Duggan and Subramaniam Ramanarayanan, has produced yet another fascinating paper on consolidation in the health insurance industry (I mentioned another of her papers in this area in a prior post). Their latest, “Paying a Premium on Your Premium? Consolidation in the U.S. Health Insurance Industry” (NBER, October 2009) examines the effect of health insurer consolidation on premiums and health care workers’ employment and earnings.

Three of the authors’ main results are that due increases in insurer concentration: (1) Between 1998 and 2006 premiums increased 2.1 percent. (2) Between 1999 and 2002 physician earnings declined by 2 percent. And (3) over the same period health worker employment declined 2.4 percent. Let’s put these results in context.

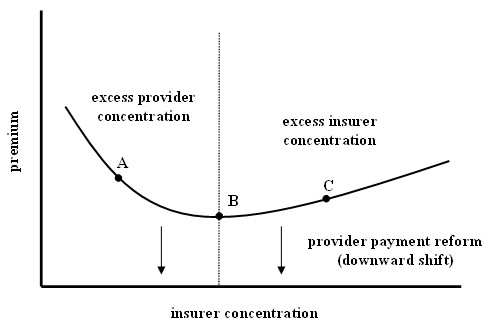

Recall the figure I introduced in an earlier post and reproduced below. It illustrates my hypothesis about the effect of insurer concentration on premiums, for a fixed level of provider market power. In the region in which insurers have a high degree of concentration (around point “C”), I would expect additional concentration to lead to higher premiums. This is exactly what Dafny and colleagues found.

Moreover, the authors find that the additional market power held by insurers not only led to premium increases, it also led to a reduction of input prices (physician salaries) and employment (a signal of reduced demand). The first of these phenomena is consistent with monopolistic behavior while the latter two are consistent with that of a monopsonist.

In brief, the findings suggest excessive insurer market power relative to providers. But how excessive is it? That is, is the market operating closer to point “C” or to point “B”? We don’t know, but a related piece of evidence is that over the time period of the study premiums increased 100%. So the measured effect of insurer concentration on premiums–a 2.1% increase–is quite small relative to the overall increase in premiums and the degree of increase in concentration in the insurance market (the fraction of the market deemed “highly concentrated” rose from 68% to 99% in the study period).

Whether the market was operating closer to point “B” or “C,” the slope of the curve in the region it was operating is modest. Despite the large increase in concentration, the vast majority, about 98%, of the observed increase in premiums was due to other factors, including additional provider concentration, medical technology, increased consumer demand, and so on. This suggests that additional insurer concentration is not an important factor relative to all others. Note that this is a result on the change (the additional) market concentration and says nothing about the level.

Can we therefore conclude that insurer concentration is not a substantial factor in premium inflation? That would be going a bit too far. After all, this study, like all studies, has limitations. It is beyond the scope of this post to go into them but there are several reasons why the results may not be generalizable to the entire health insurance market. Some of the reasons are provided in the paper itself, and a few others were raised when this paper was presented at the 2009 Annual Health Economics Conference hosted by the BU School of Public Health (at the time of this writing some conference papers are still online at the bottom of the web page).

So I am very enthusiastic about this paper but interpret the results with caution. This measured reaction is totally normal. All studies, even good ones such as this, have limitations. That’s why one should base conclusions on a body of work that looks at the same issue from multiple perspectives, using different data and methodology. Nevertheless, this is a good paper on an important problem using appropriate methodology. I encourage you to read the entire manuscript.