Lately I’ve been hearing a lot about hospital-physician integration. Curious, I found some papers on the topic, which I don’t claim to be anything like a representative sample. (That’s a cue for knowledgeable readers to suggest what they know on this topic.) I found two papers from 2008 that provide general guidance on this topic, and two from 2006 that provide some economic analysis. I’ll discuss them in that order.

Hospital-Physician Collaboration: Landscape of Economic Integration and Impact on Clinical Integration, by Burns and Muller (Milbank Quarterly, 2008) seems to be th encyclopedic article (ungated, by the way). The authors list separately the noneconomic, economic, and clinical types of integration, with a greater focus on the latter two types. Noneconomic integration refers to techniques by hospitals to change physicians’ motivations or incentives with non-financial means, like “technology acquisitions, hospital branding, process flow improvements, management information systems, physicians’ liaisons, referral services, clinical councils, physician leadership development, medical staff development, and additions to the number and skill mix of the nursing staff.”

Economic integration involves payments by hospitals to physicians, though the arrangements can take many forms, including “professional service agreements, medical directorships, stipends, performance bonds, management contracts, gain sharing, leases, and comanagement of clinical institutes and centers of excellence, […] joint-venture investments, […] joint-risk reimbursement contracts from payers.”

Finally, clinical integration involves elements of patient care, such as “utilization management programs, scheduling and registration systems, information systems that can track utilization by patient and provider, development of care standards, continuous quality improvement programs, clinical service lines, case management systems, population-based community health models, disease and demand management systems, common patient identifiers, and disease registries.”

The authors then go on to describe in detail various types of economic and clinical integration, goals of hospitals and physicians in entering such arrangements, the extent to which they overlap, and a great deal of literature on how various innovations have faired. It’s an ambitious review, citing a lot of literature, and not easy for me to absorb. In summary, the findings are,

The goals of the two parties in HPRs [hospital-physician relationships] overlap only partly, and their primary aim is not reducing cost or improving quality. The evidence base for the impact of many models of economic integration is either weak or nonexistent, with only a few models of economic integration having robust effects. The relationship between economic and clinical integration also is weak and inconsistent. There are several possible reasons for this weak linkage and many barriers to further integration between hospitals and physicians.

Hospital-Physician Relations: Two Tracks and the Decline of the Voluntary Medical Staff, by Casalino, November, Berenson, and Pham (Health Affairs, 2008) covers much of the same ground, albeit in far less depth and using the Community Tracking Study. The authors decompose the landscape into two “tracks,” the first of which is “physician employment by hospitals” and the second of which is “separation and competition with hospitals.” Physician employment encompasses the economic and clinical integration described above. Separation and competition refers to physician ownership of ambulatory surgical centers (ASCs) and specialty hospitals.

The authors discuss motivation for the two tracks and where they might lead. The conclusion is a bit of a muddle, reflecting the heterogeneity of arrangements across examined markets.

The pressures on hospitals and physicians suggest that at least for the foreseeable future, the voluntary medical staff model will continue to decline. Although it has its attractions, few believe that it is well suited to improving the quality or controlling the costs of medical care. For the near future, at least, it appears that physicians will increasingly choose the path of hospital employment or of separation from hospitals, with the two paths coexisting in some communities, while one path or the other predominates in others.

There is obviously an enormous amount of detail in these papers that I did not even hint at, let alone discuss. One reason, other than space and time constraints, is that this is a very messy literature. In broad stroke, the motivations for vertical integration between hospitals and physicians are relatively clear: there’s the economics and there’s improved quality, though it is the former that seems to be the main driver. While these motivations spawn a lot of different arrangements, they combine to drive out the voluntary medical staff model and promote direct employment or competition. On the whole, there is not a lot of evidence that costs come down or quality improves.

The other two papers I’ll quickly summarize come to opposite conclusions about the consequences of hospital-physician integration. The key question is: does integration lower hospital prices by exploiting economies of scope, or does it raise them by increasing market power?

Before I answer that question, let me ask a different one: in terms of hospital-physician relations and their consequences, is California a lot different than Arizona, Florida, and Wisconsin? It seems so! Over a similar, but not identical, time period (roughly the mid- to late-1990s), one study finds that integration did not lead to price increases (California) and the other study finds that integration did (the other states). Both papers appear in the same 2006 issue of the Journal of Health Economics:

- The Effect of Physician-Hospital Affiliations on Hospital Prices in California, by Ciliberto and Dranove

- Strategic Integration of Hospitals and Physicians, by Cuellar and Gertler

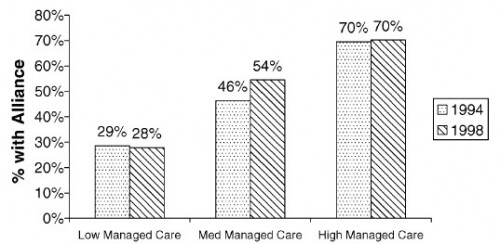

Both papers cover similar background on economies of scope and market-power effects of integration, citing some of the same papers, but the Cuellar and Gertler paper is more expansive. Anticipating their results, Cuellar and Gertler also present the following chart, which shows that integration is more likely where managed care is more common. This is consistent with the notion that providers seek integration in response to growing market power by insurers.

However, this was the 1990s, when health insurer market power was growing. Can we extrapolate to today’s health care markets? It’s not clear to me we can. That’s not to say integration isn’t occurring for market power reasons. It very well may be, among others. But are providers responding to insurers’ market power or are they out ahead of them, consolidating power beyond that which they already have?

I confess, this area is a muddle to me. I don’t think the literature as caught up and the prospect of ACOs does add a new wrinkle.