Aaron and my posts are starting to go up on Ezra Klein’s blog, where we’ll be all week. You should be reading them there. (Seriously, is there a single TIE reader that does not read Klein?) However, we will cross-post here too. This is the first one.

Recently, Kevin Outterson suggested to me an interesting way to organize the health policy debate. There are three principal fault lines dividing Democrats and Republicans, which I describe below. Being a bit stylized (as abstractions must), the divisions are not pure. Sometimes the tectonic plates shift.

Fault line 1: Risk pooling. Broadly speaking, the Democratic approach to risk pooling is to broaden it. At the liberal extreme is single-payer, Medicare-for-all style or even fully nationalized (a la the U.K. or the VA). In either case, that’s the biggest possible risk pool. Stepping rightward from the extreme are other reforms aimed at broadening the risk pool, leveraging healthy participants to fund the unhealthy: guaranteed issue, individual and employer mandates, premium subsidies, eliminating lifetime caps, and instituting nondiscrimination rules. Not all of these are or were solely favored by Democrats, but they characterize the broad view on the left on risk pooling.

The Republican approach tends toward risk pool fragmentation, more “personal responsibility” than “all for one, one for all.” The thrust of late from the right has been more consumer cost sharing (high-deductibles, Rep. Ryan’s Medicare voucher plan), looser regulation, cross-border competition, no mandates and the like. All of these weaken or rely less on the risk pooling mechanism of insurance. If everyone were in a high-deductible health plan, the risk pools would be completely individual in the deductible range.

Fault line 2: Medical cost-benefit decisions. This fault line is centered on who decides what care you receive, or, to be more precise, what care is covered by insurance (public or private). Democrats favor a high degree of aggregation, using population-based comparative- and cost-effectiveness research to inform coverage decisions. Republicans want individuals to make those decisions in consultation with their physician.

The two are not, in fact, mutually exclusive. To the extent there is a difference it is whether the patient/doctor-level decisions are (a) informed by research and (b) covered by insurance (public or private). This divide is clear between the IPAB (experts) and the “empowered consumer” (market) models.

Fault line 3: Rational choice in insurance markets. If the second fault line is focused on medical decisions, the third divides views on insurance purchasing decisions. Democrats favor standardization and regulated, managed competition-style markets in which individuals’ choices are somewhat constrained. Republicans are more apt to propose greater consumer choice, freer markets and greater flexibility.

At the heart of the divide is a difference in presumption about the ability of individuals to make rational choices. Republicans think individuals can be highly rational, savvy shoppers in the health insurance marketplace. Democrats are more skeptical and, therefore, seek more consumer protections such as the exchanges and insurance regulation. The structured Medigap market is in the classic Democratic form, for example.

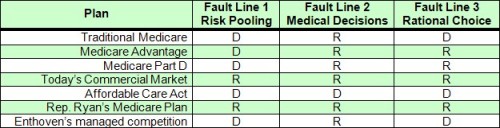

Conclusion. The chart below characterizes current and proposed insurance markets according to the three fault lines. For each fault line, D = Democratic and R = Republican, as defined above.

Looking at this table, we see that the ACA is most clearly Democratic and today’s commercial market and Rep. Ryan’s Medicare plan are most clearly Republican. Drilling down, the two major controversial changes in the ACA were (1) the specific tools used to manage risk pooling (the mandate and insurance market rules) and (2) strengthening population-level cost containment (IPAB and comparative-effectiveness research). These fall within the purview of fault lines 1 and 2, respectively.

Meanwhile, Ryan’s plan for Medicare is controversial in the way it fractures the risk pool and relies on personal choice. It does this by removing the single largest pool, traditional Medicare and by providing subsidies for private plans designed to erode over time. Fault lines 1 and 3 are at play here.

Many of the table entries are debatable. In fact, I was torn about some entries myself. For example, the ACA’s exchanges could be considered an R on risk pooling, particularly if premium subsidies erode, about which I’ll say more in a subsequent post. But the ACA preserves traditional Medicare and continues to support Medicare Advantage (though with lower funding), giving it a clear D in the risk pooling category for Medicare overall.

It’s fitting, even expected, that the ACA has a somewhat ambiguous political orientation. Though it was passed by Democrats, it includes ideas previously endorsed by Republicans. Moreover, when a political fault line so sharply divides, perhaps the only thing that can pass is something that straddles it.