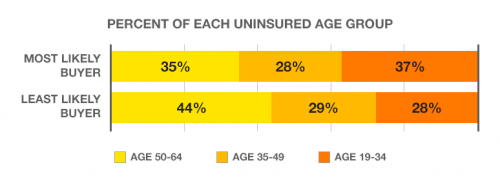

Thought “rate shock” was just a plight of the young? Think again. Recent survey findings from Deft Research suggest that the uninsured cohort least likely to buy insurance on the exchanges is the oldest one, those aged 50-64. In an interesting narrative twist, the youngest individuals surveyed (ages 18 to 35) actually seem most likely to buy.

Deft’s research shows that the least likely buyer is older and wealthier than the most likely buyer. By being wealthier, their health insurance subsidies will be smaller. Because they are older, they will see higher cost health insurance […] Deft’s study found that many older uninsured persons will find even their subsidized premiums to be too expensive. They will take a tax penalty rather than purchase health insurance – at least in the first year of reform.

The survey tells a story consistent with the Bloomberg column Austin and I coauthored last week. Rate shock is a real thing: premiums for the healthy are going to rise. But it’s not a cross-subsidy from the young to the old, as some critics contend. It’s tied to health status—the healthy are subsidizing the sick, at all ages.

Adrianna (@onceuponA)