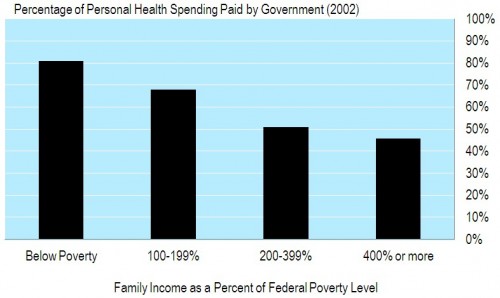

Below is a pre-publication version of a chart that appears in Chris Conover’s The American Health Economy Illustrated.

How do individuals with incomes 400% or more of the federal poverty level get so much taxpayer assistance? The biggest single source is the exclusion from taxation of employer-sponsored health insurance. Medicare is the second biggest source. Additional detail in Exhibit 4 of the paper by Seldon and Sing, from which the data in the above chart were taken.