Today’s chart comes from a new Health Affairs paper by Daniel Austin and colleagues. They simulate the effect of rising employee contributions for employer-sponsored insurance (ESI) on exchange participation and net federal costs. There can only be a relationship for employees eligible to switch from ESI to exchange-based coverage. Who are those?

For employees to be eligible to switch to exchange-based coverage from employer-based coverage, their current premium payment contribution must exceed 9.5 percent of their income.

That’s the law.

Next, isn’t it straight-forward how much switchers will cost the federal government in subsidies? Well, no. There are a few issues to consider. In particular, it’s not all cost. There are some revenues too. There’s the employer penalty, which depends on firm size (zero for small enough firms) and on whether the employer offers coverage. (Details here.) But, there’s more.

Within a competitive labor market, employers that drop insurance coverage must reimburse employees for the decrease in total compensation. In calculating revenues, we assumed that once a household switched to exchange-based insurance, the previously untaxed premium contribution for employer-based coverage would become taxable income and be taxed at the household’s current marginal tax rate (in addition to Medicare and Social Security deductions on eligible income).

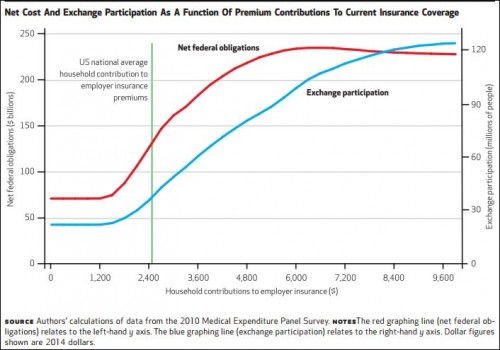

The upshot is depicted in the following chart.

At that baseline level, annual federal outlays for exchange subsidies would be $132 billion (in 2014 dollars). […]

The exhibit shows how changes in household premium contributions for employer-based insurance lead to changes both in participation in the exchange and in net federal outlays. As household premium contributions rise, people are increasingly eligible and motivated to participate in the exchange, because they will receive a federal premium subsidy and an effective wage increase (to compensate for leaving employer-provided insurance). At the lowest premium contribution levels, only subsidy costs (premiums and cost sharing) are incurred for currently uninsured people with incomes of 133–400 percent of poverty. At higher contribution levels—that is, at increasing levels of exchange participation—federal government obligations start to equal revenues from taxes and employer penalties. […]

Importantly, our findings show that changing theoretical premium contribution levels by just $100 could induce 2.25 million people to transition to exchanges and increase federal outlays by $6.7 billion.

That’s $6.7B on a base of $132B, or 5%. (I don’t point this out to suggest it’s small or large, but just to put it in context.)