Recent studies have credited Pioneer ACOs with some savings, though less to none accounting for program costs. How do those study results square with predictions? I actually don’t know, and I’m not sure anybody does. The Pioneer Program is a demonstration program within the Center for Medicare and Medicaid Innovation. Demos don’t get scored (I’m told).

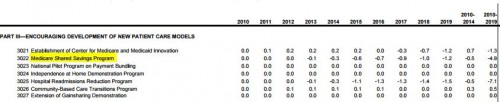

I can, however, find* predictions of savings from Medicare’s Shared Savings Program, which is a larger and slightly different ACO program than Pioneer. (Learn about the differences here.) Those predictions are below.

When reading the following, keep in mind that today Medicare costs over $500 billion per year. So, when discussing 10-year budget savings, compare figures below to something on the order of $5 trillion. In other words, $5 billion savings over 10 years is roughly 0.1 percent of total Medicare spending.

[1] In December 2008, the Congressional Budget Office (CBO) provided some clues to its thinking about ACOs (which, at the time, it called Bonus Eligible Organizations, or BEOs). Under the assumption that 20 percent of beneficiaries participated in such an organization by 2014 and 40 percent by 2019, CBO scored $5.3 billion in savings over 2010-2019. Today, only 7 million beneficiaries are associated with ACOs, or about 14 percent. The savings would decline over that span for several reasons, one of which is that as organizations became more efficient, bonus payments would grow. CBO warned that their prediction was highly uncertain because it was not clear precisely how organizations would respond to financial incentives and due to the voluntary nature of the program. Regulations are evolving to attract and retain more organizations, which often means paying them more.

[2] In scoring the ACA in March 2010, the Congressional Budget Office (CBO) predicted savings of about $5 billion over the original 10-year window from the Shared Savings Program.

[3] In 2010, the CMS actuary credited the Shared Savings Program, among many others, with zero savings for every year through 2019.

[4] For what it’s worth, prior attempts at care coordination programs tended not to produce savings. Researchers have found modest savings for the Physician Group Practice Demo and savings from private-sector ACO-like contracts.

My guesses: the CMS actuary is probably wrong on the low side, but possibly not by much. CBO’s estimate could be close to right, but possibly too high. We already see some savings from Pioneer ACOs, for example, but fewer beneficiaries are associated with ACOs than expected and modifications of regulations may increase program costs.

People who think ACOs will definitely turn the tide of health care spending once and for all are overconfident. Maybe ACO savings can grow over future decades, but it’d have to do some significant compounding to reach a substantial portion of total Medicare spending this century. One way it could compound is if ACOs succeeded in controlling the diffusion of expensive, new health care technology.** I am unaware of anyone making an explicit argument that they will do so.

* By “find” I mean that I asked Loren Adler, and he emailed me links.

** If I’m doing the math right, with 0.1% savings relative to all of Medicare spending in the first decade, even if that doubled every decade, we’d only see about 0.8% savings by 2100.