It remains controversial whether some unit of geography is the right frame to view and/or address variation in health care spending and outcomes. What should not be controversial is that some variation remains in both spending and outcome (or quality) dimensions even after controlling for observable patient factors. That suggests that different health systems (whether defined by geography or other relationships) have different levels of productivity. It’s natural and appropriate to want to increase the low productivity of lagging health systems and to strive close the productivity gap between health care and other sectors. Can we do so?

The new Institute of Medicine (IOM) report, and the good work upon which it is based, documents productivity variation both in Medicare and in the commercial market, though, with respect to spending, operating differently through price and volume between the two. (Jordan Rau wrote a good summary of the report.) Focusing on Medicare, the IOM committee attributes most spending variation to post-acute care. Recent work by Amitabh Chandra, Maurice Dalton, and Jonathan Holmes documents large spending growth in this sub-sector.

We found that spending on postacute care—long-term hospital care, rehabilitation care, and skilled nursing facility care—was the fastest growing major spending category and accounted for a large portion of spending growth in 1994–2009. During that period average spending for postacute care doubled for patients with hip fractures, more than doubled for those with congestive heart failure, and more than tripled for those with heart attacks.

About Medicare spending for post-acute care, reader BillNRoc’s comment is insightful.

Elsewhere in their essay, Fisher and Skinner recognize that increased spending on post-acute care is not (for the most part) driven by providers of post-acute care; it’s driven by the practices and actions of hospitals and doctors.

For one example: hospitals and heart surgeons worked hard to shorten length-of-stay for coronary bypass patients, but to achieve that objective they needed cooperation from home health providers to hire nurses with higher skills and apply technology with higher costs. Hospitals still make bundles on surgery, but now home health agencies are providing more services to more patients that drive up overall Medicare spending.

For another example: in the world of DRGs and public mortality statistics, hospitals wanted to reduce (a) length-of-stay for patients who are terminally ill and (b) frequency of those patients dying in acute-care settings. Hospices — some of them owned by hospitals and hospital-based systems — step up and help hospitals achieve those business objectives.

BillNRoc is taking a systemic perspective, recognizing that post-acute care does not exist in a vacuum. Any complete approach to addressing spending and quality can’t focus on just one type of provider, as the same (or similar) care can be delivered in multiple settings.

In their report, the IOM committee recommended reforms aimed at increasing productivity in the health sector.

CMS should continue to test payment reforms that incentivize the clinical and financial integration of health care delivery systems and thereby encourage their (1) coordination of care among individual providers, (2) real-time sharing of data and tracking of service use and health outcomes, (3) receipt and distribution of provider payments, and (4) assumption of some or all of the risk of managing the care continuum for their populations. Further, CMS should pilot programs that allow beneficiaries to share in the savings due to higher-value care.

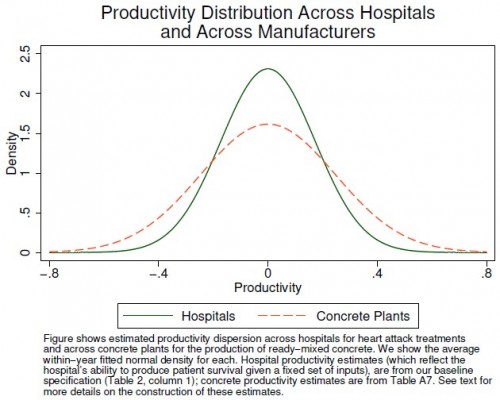

Whether you agree with these recommendations probably has a lot to do with the precise way in which reforms are implemented. However, abstractly, a focus on productivity seems appropriate. Though hospital productivity growth has lagged that of the rest of the economy, it is interesting to recognize that productivity variation in health care may not actually be that different from other industries for which we exhibit little concern. This fact is one of the insights revealed in a recent paper by Amitabh Chandra and colleagues (see the figure and its caption below).

The investigators also found that hospitals with higher productivity have higher market share. That’s rare and comforting evidence of a lack of dysfunction in health care markets. Despite the known troubles, something seems to be working correctly.

In particular, we find that hospitals that are more productive at treating heart attacks have higher market shares at a point in time and are more likely to expand over time. For example, a 10 percent increase in hospital productivity today is associated with about 4 percent more patients in 5 years. Taken together, these facts suggest that the healthcare sector may have more in common with “traditional” sectors than is often assumed.

The extent to which the health care sector is, objectively, different from others may be smaller than we tend to believe. This does not mean we would not be better off with greater productivity. Productivity is always important. Nevertheless, health care is different. It’s more intimately and immediately about us, our lives and well-being, in a way that ready-mixed concrete (apparently) isn’t. Health care is visceral, and that matters on a deeply emotional level. This, along with its historically intensive reliance on skilled labor and other factors, helps promote market failure and suppresses productivity growth.

As much like concrete the health care market can be made to seem or actually is, there are, at least, some important sources of health care exceptionalism. When optimistic, we assume they’re malleable. When unrealistic, we ignore them. When humble, we acknowledge just how hard health system change really is. The IOM report is both a product of that fact and the latest attempt to persevere in spite of it.