My cross-campus Chicago colleague Kevin Murphy doesn’t share my politics or my keen fashion sense. He does, however, write kickin’ economics papers. I’ve been reading one of those papers that’s been out for awhile now: Murphy and Robert Topel’s, “the value of health and longevity,” Journal of Political Economy in 2006.

Austin has noted this piece in a previous post. As he notes, the two authors begin in bravura fashion: “In 1900, nearly 18 percent of males born in the United States died before their first birthday; today, cumulative mortality does not reach 18 percent until age 62.” The paper is worth reading simply to sample such amazing statistics. I’m learning from it for another reason, because it illustrates the value of relatively simple economic theory to clarify complex matters.

Using the language of dynamic models combined with admirably clear prose, Murphy and Topel present an optimizing framework for valuing medical investments to extend life and improve health. This mathematical setup provides analytic foundations for the discipline of cost-utility analysis (CUA), the standard approach to medical cost-effectiveness.

As regular TIE readers already know, in examining public investments ranging from mammography screening to guardrails that lengthen life or improve health, it is helpful to rank the options in terms of what they would cost per unit of improved health outcome. The standard unit of health outcome is called a QALY, shorthand for “Quality-adjusted life-year.” Roughly speaking, one QALY corresponds to one year in excellent health. The mechanics of CUA can get complicated, but the intuition is clear. If you live for a full year, but you are really sick, or you are in chronic pain, or you are in a coma, you might only receive 0.7 or 0.5 or 0.3 QALYs. These differences should sometimes matter when we allocate scarce public resources.

Just how these differences should matter gets practically, empirically, and ethically messy. I can’t say much about these complexities now. That’s a column for another day or for another blog. It turns out that the American electorate is willing to pay more than $150,000/QALY for a wide range of reasonable interventions. Such figures provide useful benchmark in evaluating competing public investments.

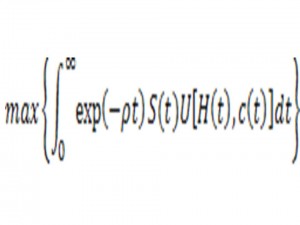

Murphy and Topel explore these issues solving a mathematical optimization problem a little more intimidating than the one below:

Okay that looks forbidding. Don’t worry if the calculus is gibberish to you. I can’t get into the mechanics, but the basic issues can be expressed in plain English. At any time t, one enjoys a health status H(t) that may influence prior health habits and medical investments. One chooses some level of personal consumption c(t) that generates an immediate utility U(c(t),H(t)). The function S(t) represents a survival function. At any given moment, one has an associated mortality risk, which reflects age, medical technology, and various personal and social investments in health. One makes health and non-health choices over time to maximize a lifetime stream of utilities, accounting for personal impatience, investment returns, and other financial constraints.

The mathematical models leave much out. Sometimes this leads us astray, but leaving the right things out is valuable, too. The resulting clarity and simplicity—okay simplicity to those of us who went through grad school boot camp—allows us to focus on critical things. Uncluttered models allow us to make explicit the economic tradeoffs implicit in our health care spending and the economic value of improved health made possible by our prodigious medical care economy.

Not to get all gooey and sentimental, but the value of a year of life at any age is simply the marginal rate of substitution between mortality risk and one’s financial assets. Given this, one can calculate the value of a statistical life and individuals’ willingness to pay for improvements in health.

When Murphy and Topel marry their mathematical model to available data, they find that Americans are willing to pay a surprising amount for a healthy year of life. Moreover the values vary over the life course. Murphy and Topel find that the value of a single life-year peaks at over $350,000 around age 50—a figure that drops by more than half by age 80 but still exceeds $150,000 per year. Why the variation? People have varying health status over time. All else equal, it’s more fun to be 25 than to be 75. Earnings capacity matters, too. If I buy myself an extra year of healthy life at age 45, my higher wage allows me to purchase more fun experiences than I could finance at age 20 or at age 80.

Playing out these analyses demonstrates that our improved health and longevity have brought huge economic gains. Murphy and Topel examine changes in U.S. life-tables over the 20th century. They find huge gains, especially at birth and at young ages between 1900 and 1930.

Our parents’ and grandparents’ generations experienced much more dramatic improvements than we have, with declines in infant mortality, the emergence of antibiotics and vaccinations, and more. Even leaving aside huge survival gains in infancy and childhood, a typical 30-year-old man in 1990 would demand a payment of $1 million to accept the expected lifespan of 30-year-old counterpart experienced in 1900 (from 34.9 to 46.2 expected years of remaining life). Women enjoyed even greater gains, since they experienced greater gains in life expectancy.

Post-1970 gains are less dramatic. The benefits still amount to hundreds of thousands of dollars per middle-aged person. As David Cutler and colleagues have explored, a surprisingly large chunk of recent gains is associated with reduced male heart disease mortality. Murphy and Topel find that post-1970 health gains are estimated to have “added $3.2 trillion per year to national wealth.”

Increased expected lifespan changes life in other ways, too. When you face the opportunity for prolonged lifespan after age 65, this has major implications for personal savings and for other kinds of decisions, such as whether to do those extra crossword puzzles or whether to quit smoking. Progress on one front often raises the value of other medical innovations. Declining heart disease mortality has raised the economic returns of research advances in the fights against cancer and dementia.

These results provide little cause for complacency. Our health system has so many defects and inefficiencies. As Austin notes, none of these results address the relative efficiencies of our system compared to others. Peer wealthy democracies have achieved equal, probably greater health gains at markedly lower cost, and have fairer, more disciplined health systems. At the margin, Murphy and Topel can’t say whether we are doing too much or too little in the treatment of costly conditions, or whether we could be getting the same outcomes and simply paying lower prices for them.

We still should be grateful that we were born when we were, and not within our parents’, our grandparents’, or our great-grandparents’ generations. Health services account for more than 17 percent of our GDP. We must be more efficient and fair in spending it. Still, as my friend Jamie Galbraith recently reminded me, it’s still the best 17 percent of GDP we have.

(HAP)