The following has been cross posted at The New Republic’s Citizen Cohn.

Earlier this week the Obama Administration released a report that described savings to the Medicare program that are predicted to follow from changes mandated by the Affordable Care Act. If those savings–$575 billion over the next decade–actually come to pass, they will represent the beginning of what one prominent researcher thinks is the inevitable bending of the health care cost curve.

In a recent article in Health Affairs, Harvard health economist Joe Newhouse arrived at that sense of inevitability by process of elimination.

[I]t is hard to imagine that reductions in the rate of Medicare spending growth will not be made at some point. One way or another, the steady-state growth rate will fall; the curve will be bent. But it is equally hard to imagine cutting only Medicare spending while spending by the commercially insured under age sixty-five continues to grow at historic rates, which would lead to a marked divergence between what providers are paid for treating the commercially insured relative to what they are paid for Medicare beneficiaries. This gap could jeopardize Medicare beneficiaries’ access to mainstream medical care.

To take Newhouse’s sense of curve bending certitude seriously is not to assume he’s right or wrong, but to examine the possibilities. If Medicare costs keep escalating 2.5 percentage points above GDP, as they have been in recent decades, the program will double in size relative to GDP in 20 years (from 5% to 10%). How will that additional spending be financed? Consider the options:

Take on more public debt to finance Medicare? In the current and foreseeable political climate, that seems an unlikely choice, if not a fiscally irresponsible one. Debt-financed Medicare can’t be a long-term solution.

Raise taxes? Newhouse calculates that income tax rates will have to increase by 160% by 2050 to cover Medicare costs. Can you imagine any politician suggesting, let alone voting for, increasing the marginal rate for those in the 25% income tax bracket to 66%? Me neither. Not going to happen. (By the way, federal tax revenue has stayed within a fairy steady band of about 15-20% of GDP for sixty years. That suggests a small appetite for radical increases in taxation.)

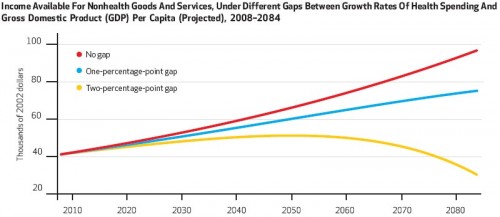

What about decreasing spending on other government services? Newhouse provides the following figure illustrating this idea (click to enlarge). If health spending increases at just 2 percentage points above GDP (which is low by historical standards), government spending on non-health goods and services must plummet (yellow line). If such a reduction in government non-health spending seems unlikely too, then by process of elimination the health care cost curve must bend. After rejecting increased debt, taxation, or reductions in non-health spending it’s the only option left.

It’s worth noting one wrinkle revealed by this figure. Real government spending on non-health functions need not decrease until after 2050. So, one could imagine sustaining four more decades of high health care cost growth. Given population growth, there would have to be great strides in productivity and efficiency in non-health sectors to pull this off. Wanna count on that?