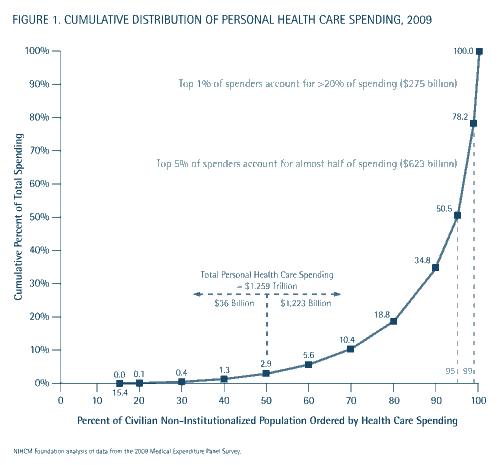

This is from the NICHM, in their recent brief, “The Concentration of Health Care Spending“:

That’s the cumulative distribution of personal health care spending from 2009. There are so many ways to talk about this. One thing to note is that the top 5% of spenders (some of the sickest among us) account for about half of all health care spending. More significantly, the bottom half of spenders (ie the healthier half) account for less than 3% of all health care spending.

When we talk about incentivizing people to forego care, we’re talking mostly about healthy people. When we talk about consumer directed health care, we’re talking mostly about healthy people. We don’t want sick people to avoid care. We want to stop healthy people from consuming it. The problem is that healthy people consume so little care to begin with. If we could incentivize the healthier half of people to forego all their personal health care spending, we’d spend $36 billion less out of a total $1.259 trillion in personal health care spending. That would be a drop in the bucket. And no one – no one at all – thinks we can get people to stop all their health care spending.