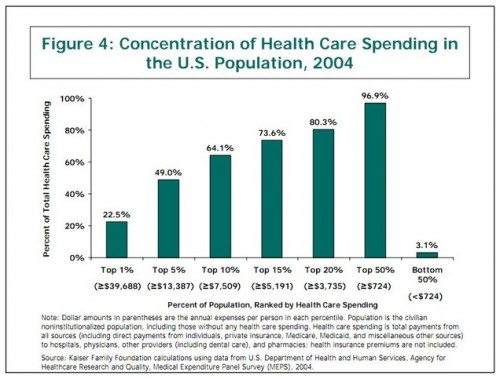

Thanks go to Jon Cohn for referencing (and quoting) a very good Movin’ Meat post. It includes a Kaiser Family Foundation-produced figure that needs to appear here, if only for reference.

Let’s let shadowfax of Movin’ Meat explain, since he does it so well:

Though the data is a few years old, I doubt the distribution has changed. To emphasize, HALF of all health care costs in the US is concentrated in only 5% of the population, and 80% of costs are accounted for by the top quintile! […]

shadowfax didn’t say it, but it is in the graph, half (HALF!!!) the population accounts for only 3.1% of health care spending. All those people — every one of them — could be in a high deductible health plan which might reduce their spending by [insert your most optimistic, yet realistic estimate — I say 10%]. It would not matter! Overall health care costs would be about the same.

Moreover, high deductible plans wouldn’t do much for most of the rest of the distribution either. shadowfax explains:

So the effect here is that with such a concentration of costs in such a small segment of the population, the ability of the larger population to move the market is highly restricted. You can make 80% of consumers highly price sensitive, but they can only affect a tiny fraction of healthcare spending. And for the generally well, their costs are probably those which are least responsible for the spiraling inflation. They’re not getting $30,000 stents or prolonged ICU stays, or needing complex chronic disease management.

Conversely, those who are high consumers of health care simply cannot be made more price sensitive, since their costs are probably well beyond what they could pay in any event, and for most are well beyond the limits of even a catastrophic health insurance policy. Once you are told that you need a bypass/chemo/stent/dialysis/NICU etc, etc, etc, the costs are so overwhelming that a consumer cannot possibly pay them out of pocket. Since, by definition, these catastrophic costs are paid by some form of insurance, the consumer cannot have much financial interest in cost containment. For most, when they are confronted with a major or life-threatening illness, their entire focus shifts to survival, and they could care less about the cost. Further, many who are in this sick/expensive category have some diminished capacity with regard to their information gathering and decision-making. I’m thinking particularly of the elderly and those who have had strokes or any one of a multitude of illnesses which impact cognitive function or other functional capacity. These patients struggle with their activities of daily living — getting dressed, bathing, transportation, housing, taking their meds. Their ability (let alone interest) in price-shopping their doctors is minimal to nonexistent, even if they had an economic incentive to do so. Taking someone who has a serious illness and making them have more “skin in the game” would represent a cruel additional hardship, but would be ineffective in creating an economic environment in which consumer behavior brought down spiraling health care costs.