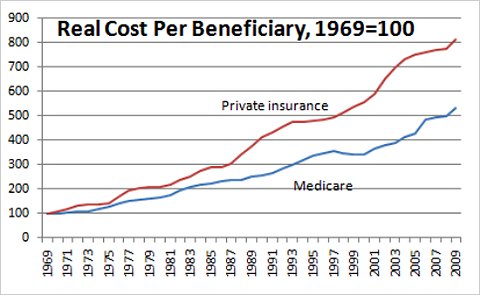

John Goodman* took issue with Paul Krugman’s interpretation of the following chart.

I’ve posted a similar chart myself. About the chart above, Krugman wrote,

If Medicare costs had risen as fast as private insurance premiums, it would cost around 40 percent more than it does. If private insurers had done as well as Medicare at controlling costs, insurance would be a lot cheaper.

Goodman responded in a post titled “Krugman gets it wrong again.” In it, he wrote,

The Congressional Budget Office has calculated excess cost growth in health care spending after accounting for GDP growth, changes in demographics and the age distribution and other factors. The CBO found that the excess cost growth in Medicare spending from 1975 to 2008 was 2.5 percentage points, on average, each year. Over the same period, the excess cost growth in Medicaid spending was 2 percentage points while the excess cost growth in all other medical spending was 1.8 percentage points. [Bold mine.]

Goodman’s figures are from the June 2010 CBO Long-Term Budge Outlook. The CBO has been reporting similar figures for years, using the same methodology, which controls for demographic change. For example, one finds the same relationship between Medicare, Medicaid, and all other health spending in a November 2007 CBO report (Medicare with the highest growth, the “all other” group with the lowest). However, in that November 2007 report, the authors explained the methodology a little more thoroughly. On page 8 they wrote,

Included in other health care spending are payments by private insurers, payments by people who lacked health insurance coverage, all other out-of-pocket payments by consumers, and health care spending by government programs other than Medicare and Medicaid.

So, “all other” is not just private insurance. It also includes out of pocket spending, even by Medicare beneficiaries, and, crucially, the uninsured. No wonder the rate of increase in spending in that category is so low. It has been pushed down by the growing ranks of the uninsured. Medicare could achieve lower rates of growth too if it failed to cover everyone who is now eligible.

It should be clear that this is a terrible set of figures upon which to base a conclusion that private spending has grown at a lower rate than that of public programs. The CBO agrees, writing,

Consequently, the differences in excess cost growth between Medicare, Medicaid, and other health care spending should not be interpreted as meaning that Medicare or Medicaid is less able to control spending than private insurers.

So, can we really be sure Krugman got it wrong, as Goodman asserted? Not by using the CBO figures Goodman cited we can’t.

* Though it is Goodman’s blog, it was actually Devon Herrick who wrote the piece I cite. (Apologies for only realizing this now, nine days after I posted this.)