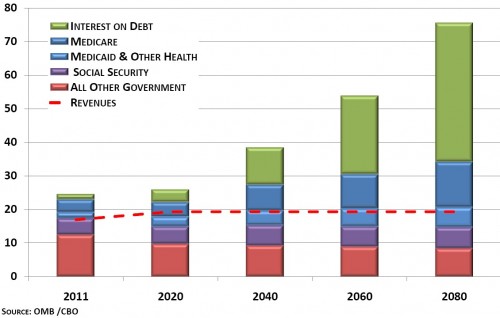

I’ve long yearned for a long-term budget projection that includes debt interest. I’m told by folks who know better that CBO doesn’t include debt interest in its long-term projections because they’re too uncertain. I’m not satisfied with that, and neither are the House Republicans. They pulled together CBO and OMB numbers to produce the following chart, which includes interest on the debt.

The vertical axis is percent of GDP. The figures are proportionally consistent with something I’ve posted before.

Using some set of assumptions (I know not what, but presume they include an “under current law” forecast), interest on the debt will consume about as much of the federal budget as will all health care spending by 2040. By 2060, interest on the debt will be akin to another entire federal budget. By 2080 debt interest will be larger than the entire federal budget. Meanwhile, if future government revenue is no higher than it has ever been in the past, relative to GDP (~19%), we already cannot afford the government we have, let alone the interest payments on it.

Yikes!

You know what doesn’t grow much, especially relative to the other stuff? It’s right there in red and purple: Social Security and “all other government”. The latter is non-entitlement, discretionary spending. You know, the target of cuts in the current conversation, the very thing argument over which could cause a government shutdown. We may have some uncertainty about these forecasts, but I don’t think we can have any uncertainty about how much a focus on that type of spending is going to do. Shut the government down, yell from the rooftops, jump up and down, but even cutting every dime of it — a political impossibility and a far cry from anything anyone is proposing — won’t do much good in the long run.