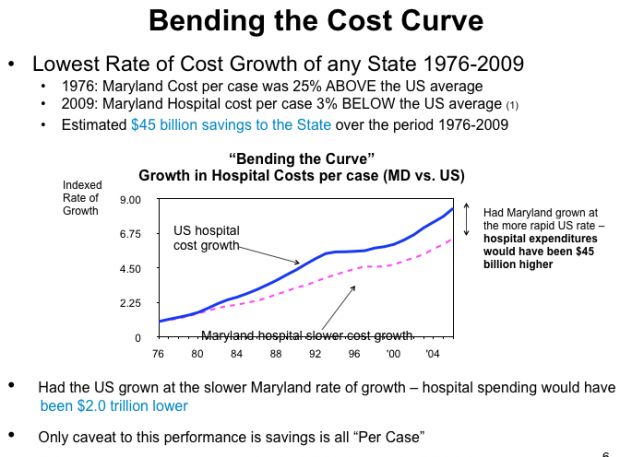

Another article is praising Maryland’s all-payer hospital price control system, this time in JAMA. Here’s the key claim:

In 1976, when the system began full operation, the adjusted costs per admission in Maryland hospitals were approximately 26% higher than the national average. Between 1977 and 2009, Maryland hospitals experienced the lowest cumulative increase in cost per adjusted admission of any state in the nation. For fiscal year 2009, the average cost per admission at Maryland hospitals increased by only 2% compared with an estimated 4.5% increase for the rest of the nation.

We’ve talked about this extensively here at TIE (all-payer tag), including a recent podcast. I’m keeping an open mind on this topic as the evidence develops, but this JAMA article repeats a weakness in some prior attempts to promote the Maryland story: success is being measured in unit prices (cost per case) rather than overall prices:

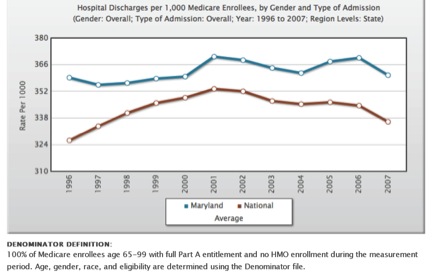

That’s a big “Per Case” caveat. How does Maryland compare on Medicare hospital discharge volume? Glad you asked:

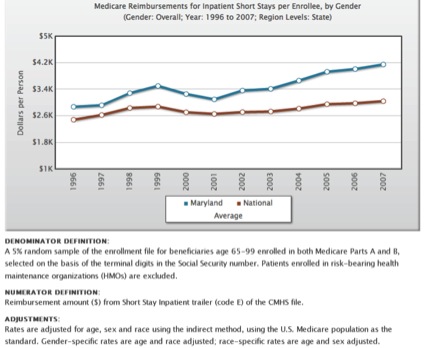

Or on hospital reimbursements per Medicare enrollee?

Or on hospital reimbursements per Medicare enrollee?

(Medicare only; from Dartmouth Atlas online query)

In Robert Murray’s 2009 Health Affairs article, he clearly describes the volume problem and how Maryland has tried to respond:

However, although costs per admission were well controlled, the same cannot be said for hospital admissions and overall hospital volume. Rate regulation was not structured to have oversight over individual physicians’ decision making, and there is no legislation currently that allows the HSCRC to establish regional hospital spending limits, which would be needed to curtail case volume increases. There was a limited break on admission growth over the period 1978–2001, when changes in the volume of hospital admissions triggered the application of fixed/variable cost adjustments to payment rates. This adjustment was eliminated in 2000 as part of a rate negotiation with the hospital industry (the expectation that managed care would control volume growth prompted the HSCRC to remove volume adjustment in exchange for a lower update formula for 2001–03). Immediately, admission rates began to increase, quickly outpacing national rates. During the period 2001–07, admissions grew at an annual average rate of 2.7 percent in Maryland versus an average annual rate of 1 percent nationally (Exhibit 2).

I’d like to hear more about tools to control overall costs and hospital volume before we all jump on the all-payer bandwagon.