This post has been cited in the 1 April 2010 edition of Health Wonk Review. See also my follow-up post on this topic.

Some have asserted that the individual mandate penalties under the Affordable Care Act (ACA) are lower than those imposed in Massachusetts. If that were the case then it would be one reason why one couldn’t generalize the experience in Massachusetts where guaranteed issue exists and near-universal coverage has been achieved with low penalties. If ACA penalties are lower than Massachusetts’ penalties then there is reason for concern that individuals might game the system–buying coverage only when sick, paying the low penalty when coverage isn’t needed–more than they appear to in Massachusetts.

So, are ACA penalties lower than those in Massachusetts? This is an empirical question, and I can answer it. The details are below, but to cut to the chase, the ACA penalty will be $674 for an average U.S. resident while the Massachusetts penalty would be $537 on average. That doesn’t mean the ACA penalty is higher for everyone. About 40% of the population would have a higher penalty under Massachusetts rules than under ACA rules. However, nearly half of those who would have a higher Massachusetts than ACA penalty are exempt from ACA penalties due to low income. Many such individuals are eligible for premium and cost sharing subsidies under ACA. Thus, the incentive for gaming is lower for this subset.

So, I don’t think it is fair to say the ACA penalties are lower than Massachusetts’ penalties. On average they’re higher, and they’re higher for 60% of of the population. If gaming is low in Massachusetts we cannot expect it to be higher under ACA based on a penalty-size argument. Hence, ACA penalties are not too low. However, the U.S. population may differ from the Massachusetts population, and other details of ACA differ from health reform in Massachusetts. For these reasons, gaming may still be an issue despite the evidence on penalty size. Keep reading if you want the details.

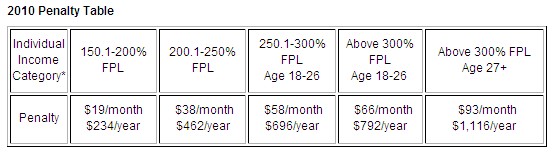

Let’s first look at the Massachusetts penalty schedule for 2010:

FPL = Federal Poverty Level. This table is copied from the Massachusetts Department of Revenue website. I believe the 18-26 age specification in the 250.1-300% band is in error, that the dollar figures in that band apply to all ages. The penalty figures shown are per adult (i.e., married couples pay double, kids are exempt).

When fully phased in (2016), the penalty under ACA will be $695 per person per year up to a maximum of three times that amount ($2,085) per family or 2.5% of household income, whichever is greater. For the penalty calculation, children under 18 count as half a person (i.e. lead to a penalty of $374.50–h/t reader Jacob Shmukler). Individuals with out-of-pocket (OOP) premium-to-income ratio above 8% are exempt from the penalty. Here, OOP premium is net of employer contribution or exchange subsidies (source for premiums: 2009 Kaiser/HRET Employer Health Benefits Survey; premiums for employer-sponsored plans not reduced by the tax subsidy, which is conservative).

With a nationally representative source of income data we can calculate what proportion of individuals would face lower penalties under ACA than in Massachusetts. To answer these questions I turned to the Medical Expenditure Panel Survey (MEPS) because I have it handy and am very familiar with it. One could also use the Current Population Survey or any number of other nationally representative surveys with income data. Because it is the latest available, I used the 2007 version of MEPS. I didn’t trend incomes forward to 2010, which is conservative to the extent incomes went up (but given the economy they likely have not).

I computed the penalty paid by each family in the MEPS sample under each set of rules, ACA and Massachusetts. I then assigned to each individual in each family an equal share of each penalty and averaged the penalties over the population, weighted appropriately to compute national means. I also computed the number of individuals for whom the ACA penalty would be greater than the Massachusetts penalty. Results:

- Mean ACA penalty: $674

- Mean Massachusetts penalty: $537

- Percent of population for whom ACA penalty > Massachusetts penalty: 60%

These results are qualitatively robust after stratifying according to exchange subsidy eligibility. Since there is little evidence of substantial gaming in Massachusetts, based on an analysis of penalty size alone there would seem to be little cause for concern over gaming under ACA, particularly for higher income individuals. This analysis ignores other differences between Massachusetts and its health reform law and the national population and ACA, respectively. Results are sensitive to assumptions, but I deliberately selected those conservatively as indicated above.