Some data on how retirees (and near-retirees) feel abut retirement:

One in four retirees think life in retirement is worse than it was before they retired, according to a poll by NPR, the Robert Wood Johnson Foundation and the Harvard School of Public Health released today. The poll shows stark differences between what pre-retirees think retirement will be like, and what retirees say is actually the case.

“Those of us over 50 and working are optimistic about our future health and health care, but that optimism is not necessarily shared by those who have already retired,” said Risa Lavizzo-Mourey, MD, MBA, president and CEO of the Robert Wood Johnson Foundation. “Many people who have already retired say their health is worse, and they worry about costs of medical treatment and long-term care. Insights from the poll can help policy makers and others think about how to meet the needs of aging Americans. There are changes we can make to our health care system, finances and communities that might help ensure that our retirement years will be as fulfilling as we hope.”

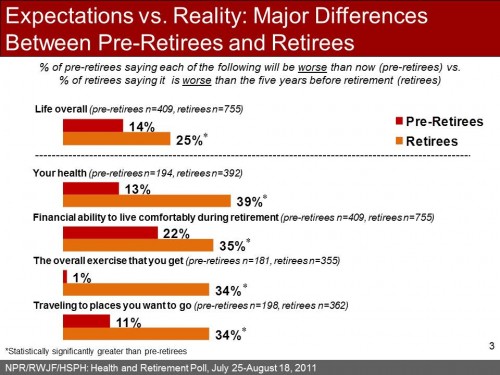

While a plurality thought life was just the same after retirement, almost as many thought life was worse than thought it was better. In fact, only about a third thought any of the individual aspects of their lives were better. What depressed me, though, was the difference between what people expected and what they found:

About 14% thought life overall would be worse after retirement, but a full quarter of retirees thought that was true after retirement. A full quarter of seniors were wrong, and found their health to be worse than expected after retirement (on top of the 13% who expected it). And while almost all seniors thought they would get enough exercise after retirement, a third found it to be worse. Also, any plans seniors had to travel in retirement may need to be reconsidered.

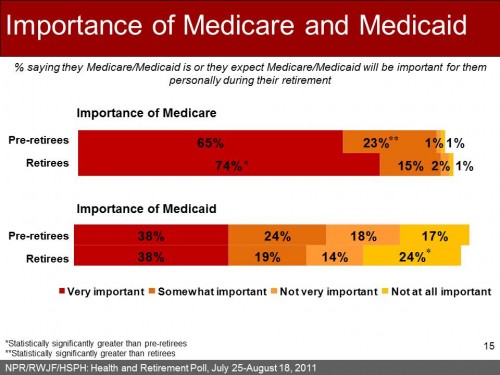

If that wasn’t bad enough, for those who think that Medicare might be able to be cut, here’s your dose of reality:

When asked, 2% of pre-retirees thought Medicare was “not very important” or “not at all important”. A whopping 3% of actual retirees felt the same. I don’t doubt this is true, but I think it signals how difficult ir will be to convince retirees or pre-retirees that Medicare can be “put on the table”.