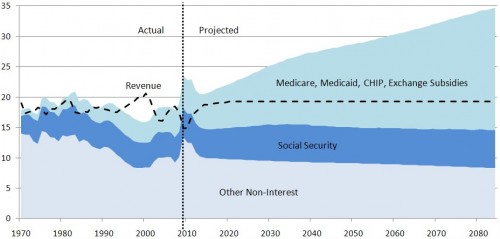

I’ve received several comments about the CBO revenue growth projection in the graph below from this prior post or a similar one from this other post.

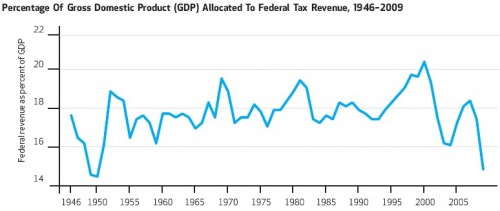

Why is federal revenue pegged just below 20% of GDP in the long-run? The answer is that the CBO believes this is the long-run maximum sustainable level of revenue, whether for economic or political reasons. That’s a very defensible position, considering this historical time series of tax revenue (from a prior post):

This isn’t magic. The revenue comes from taxes. Americans have demonstrated an unwillingness to be taxed at rates that produce more than about 20% of GDP. A more realistic, long term average is about 17-18% from the graph above.

So, what happens when we put a realistic revenue figure along side health care cost inflation and project ahead several decades? Massive debt. That’s what CBO is telling us will happen if we don’t make some major changes.

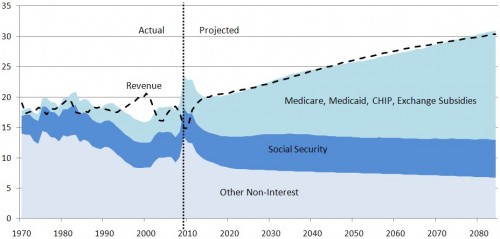

Alternatively, we can just tax ourselves like we never have before. That’s CBO’s other solution. It produces balanced budgets, but it does not seem realistic.

How do you think things will really turn out? Massive debt or taxation at a level never before experienced in this country (or not in the post-war period anyway)? Kinda seems like there needs to be a third way. Hmm, now what might that be?