This article is part of an educational video series created by BUSPH student, Tasha McAbee, and health economist, Dr. Austin Frakt, to explain the intersections of economics and health. The transcript follows the video below, which can also be found on YouTube at Health Economics Explainers.

The Covid-19 vaccines were a miraculous helping hand to a disastrous pandemic in the US. The vaccines were developed quickly and are highly effective.

But after production, comes distribution. And in an ongoing pandemic, a massive amount of the newly invented vaccine needs to be distributed as fast as humanly possible to put an end to the spread of disease.

Normally, production of a good or service could be increased by having more companies enter the market and contribute. The competition also helps keep prices affordable. But when a new pharmaceutical is invented, the United States government protects the developers from competition for a number of years by granting them patents and market exclusivity, rewarding them for their innovation with profit. The Covid-19 vaccine developers were no exception.

These governmental protections grant pharmaceutical and vaccine developers market power they would not otherwise have. In some cases they are able to act as monopolies. Although there are multiple Covid-19 vaccines, there is relatively little competition, so it’s useful to examine the effect monopolies have on production and price to understand what’s going on with the vaccines.

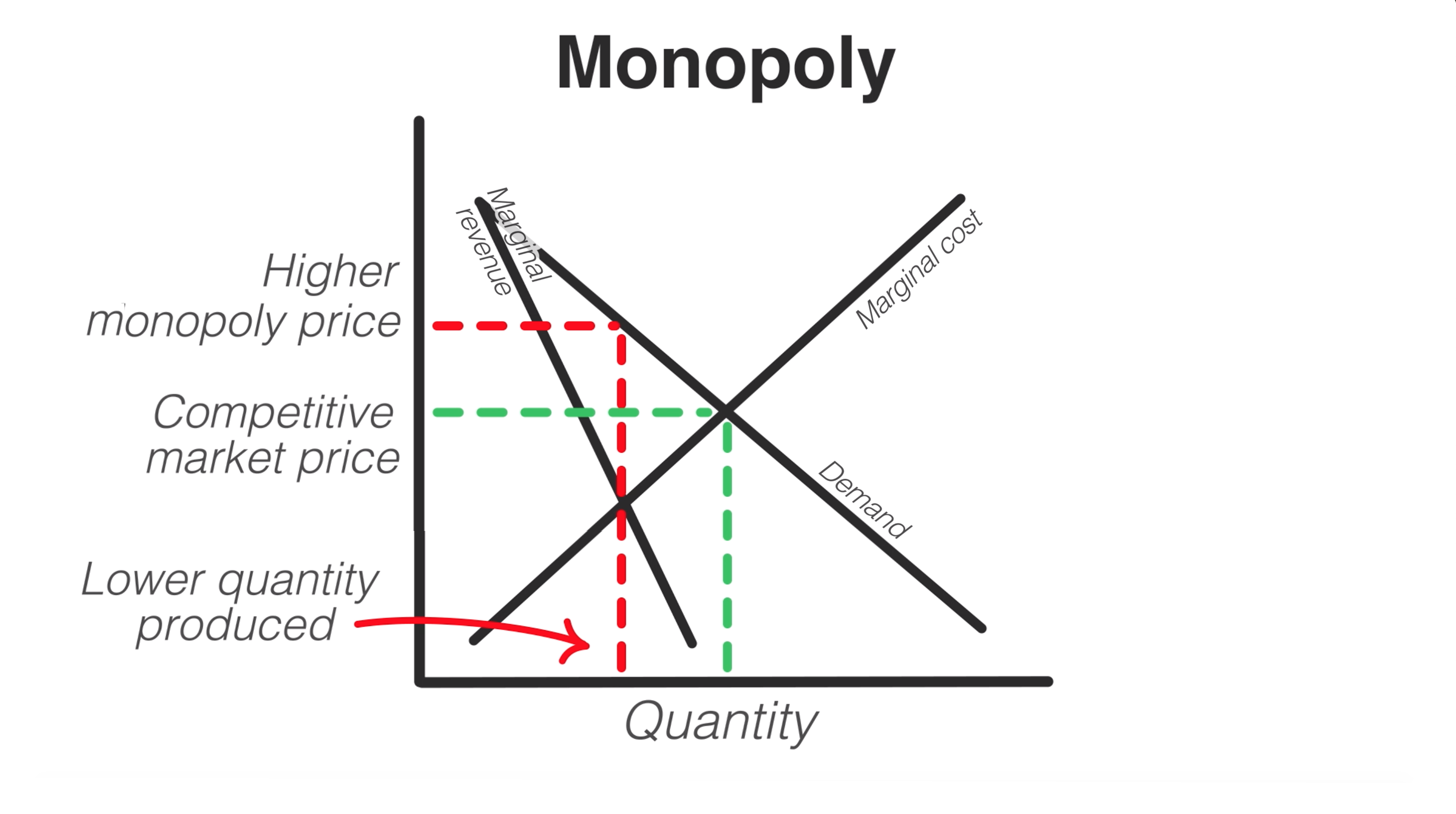

In a true monopoly, the supply curve is the additional cost to produce more of a good or service, called the marginal cost, which increases as the quantity produced increases, also causing the price to increase.

The demand curve, just as in competitive markets, is downward sloping because people will buy less of something the higher the price.

When deciding what quantity to produce, monopolists, seeking to maximize profit, look to where marginal cost meets marginal revenue, which is the additional revenue they earn from each unit they produce. Marginal revenue is also downward sloping and is steeper than the demand curve. Where these two values meet indicates the price and quantity at which the company will earn the most profit from sales, without losing money on production.

But this quantity is lower than what would be produced in a competitive market.

And the monopolist has the power to still charge a price matching the demand, while producing at the lower quantity.

While this is great for the company’s profits, low production and high prices can be a huge problem when a global population of 7.8 billion people are all in need of the same vaccine at the same time, as in a pandemic. Despite not being a true monopoly, the governmental protections granted to the few Covid-19 vaccine companies is causing this effect on production and prices of vaccines. The companies aren’t producing at a high enough rate to meet demand, and what they do produce has a high price, making vaccines both inaccessible and unaffordable to many, especially to low-income countries.

There have been calls to suspend intellectual property rights on the Covid-19 vaccines. A waiver would ensure that vaccine companies could not block others from producing vaccines, allowing more companies to join in production and help supply the world with enough vaccines, at a price more affordable to low-income countries.

The Covid-19 vaccines aren’t alone in this problem. Monopolies — or situations close to them — plague many vaccine and drug markets. The only two HPV vaccine developers, together maintaining a duopoly through similar government protections, is estimated to profit at 10 times the cost of production of the vaccine while the vaccines remain inaccessible to many in low-income countries. Keytruda, a breakthrough cancer drug, was granted 53 patents, gaining 35 years of protection from market competition. Without competition, the individual cost for a one year supply of treatment with Keytruda is over $100,000, making it inaccessible to many patients.

Governmental investment in innovation is essential and was crucial to the development of new vaccine technologies that were used in various Covid vaccines. However, the current system of creating monopolies has adverse consequences for equity. The Covid-19 pandemic is the latest example of why the US may need to find a different way of rewarding companies for innovation, one that doesn’t limit supply and risk the public’s health.