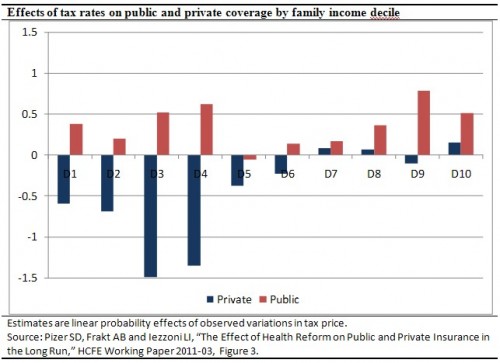

Our recent working paper raises questions about how much the Cadillac tax provision of PPACA will induce workers to shift from private insurance to public insurance. The idea is that the Cadillac tax will affect an increasing share of workers with private insurance, making compensation in wages more attractive over time (relative to compensation in health benefits). The likely result is that employer-sponsored health insurance will become less generous and some of the workers who qualify for public insurance will chose it instead. We used historical variations in tax rates to estimate how the likelihood of public and private coverage were affected by changes in tax laws. The results are shown in the chart below.

These results indicate that workers in the lowest four deciles (labeled D1-D4) are less likely to obtain private coverage when tax subsidies decline while the likelihood that they will obtain coverage from public insurance increases in response to the same tax change (although not as much). We also see an increase in the probability of public coverage among high-wage workers (especially in the top two deciles, labeled D9 and D10) that reflects improved relative attractiveness of TRICARE, the public insurance program for retired career military personnel. As discussed in a prior post, we predict that these effects will combine to shift about 3% of workers and their families from private insurance to public insurance as the impact of the Cadillac tax grows from 2018 to 2030.