A review: Under competitive bidding among Medicare plans, private health insurers and traditional Medicare would offer bids (their cost) for providing a defined benefit to an average risk beneficiary. The government would then set subsidies (premium support) at some level that is a function of the bids (like the minimum, second lowest, or average). To enroll in a plan that cost more, a beneficiary would pay more out of pocket. If a plan cost less, a beneficiary would pay less, possibly keeping the difference as cash. There are other important details (risk adjustment, low-income subsidies, and the like), but this is the basic set-up.

When many people consider such an arrangement (e.g., the Domenici-Rivlin proposal), they think or argue that it’s a way to drive traditional Medicare out of the market, or at least some markets. That’s what some folks are getting at when they raise the possibility of an adverse selection death spiral for the public option. They think traditional Medicare will become a high risk pool because private plans will outbid the public option and/or find clever ways to select good risks. However, it is not a foregone conclusion things would play out that way. There is a good argument that traditional Medicare would thrive under competitive bidding.

Often when folks analyze competitive bidding, they do so statically. That is, they examine how plans operate today. They infer plan costs today and hence their bids, or they have bid data directly (MedPAC, CBO). They work out which plan would bid lowest, second lowest, etc., and from that the subsidy or premium support. Doing all that suggests how much traditional Medicare would cost beneficiaries out of pocket. It suggests whether the plan will be cheap and thrive or be expensive and suffer in the market. That’s all fine, but it doesn’t necessarily tell us how the market will evolve under competitive bidding. And the market is not static.

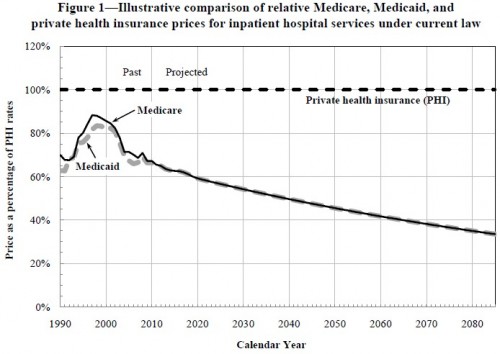

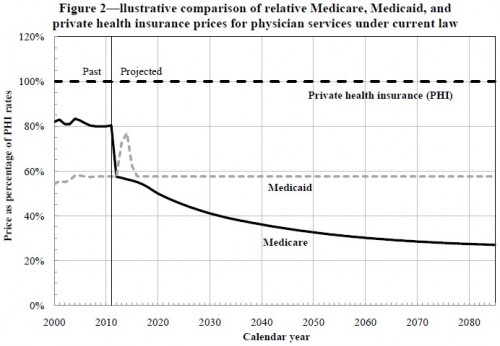

Among the moving parts are the prices Medicare will pay providers. According to analysis by the CMS Office of the Actuary, under current law they’re going to go down — way down — relative to the prices to be paid by private health insurers. Check it out:

To be sure, price is not cost, hence it is not premiums. It is possible for traditional Medicare to offer the lowest prices and still have relatively high premiums. It depends on volume. Volume is also something Medicare will be attempting to control. That’s what ACOs and bundled payments are, in part, all about. Many economists and health policy experts think that the incentives for provider integration embodied in ACOs will, in fact, tend to increase provider market power and, hence, increase private sector health prices (pdf), another advantage for traditional Medicare. Additionally, encouraging competition among private plans is exactly the opposite way to achieve low provider prices, a point made by many including Uwe Reinhardt recently.

Traditional Medicare’s volume, hence cost, is also a function of how sick its patients are (selection). It’s a bit hard to imagine that selection will be so increasingly adverse (and it is selection beyond that addressed by risk adjustment that matters here) that it outpaces the downward sloping prices Medicare is expected to pay. If traditional Medicare prices drop so far below those of private insurers and with additional controls on volume and other advantages, how is it not going to be among the lowest bidders? How is it not going to remain a very attractive option? This is precisely the argument advocates of a public option in the ACA exchanges make.

One way it might lose attractiveness is that providers stop voluntarily participating in traditional Medicare’s (implicit) “network.” Maybe that causes access problems in some areas. However, private plans can and do have networks too, which likely offer insufficient access in some areas. Some private plans have zero access in some areas! They don’t even participate in the market. Network restriction is how plans obtain low prices. Plans with greater market share can reduce prices more easily with fewer providers walking away from the table. That is a consequence of market power, something traditional Medicare has to a greater extent than any other plan.

If Medicare’s low prices become problematic for beneficiary access, it suggests that the program needs to include a network adequacy rule, for itself and for private plans. Such a rule already exists, at least for private plans (pdf) so this is quite a natural thing to extend to any competitive bidding-based program.

With network adequacy in place and prices dropping below private plans to an increasing extent, traditional Medicare may perform well under competitive bidding. Why are so many seeming to lack confidence that the program can compete? After all, look at what’s going on today. Private plans are at a tremendous advantage and have been for many years. They receive per beneficiary subsidies way above the average cost of traditional Medicare. They offer many additional benefits and many plans offer lower premiums and cost sharing relative to traditional Medicare. Still, traditional Medicare retains 75% of the market. Competitive bidding would reduce the overpayments to Medicare Advantage plans, reducing the advantage they have in the market today.

Thus, I think there is a chance traditional Medicare would do just fine under competitive bidding. It might even thrive. This is, admittedly, speculative, and it depends, in part, on what Congress allows the plan to do, which depends on how any competitive bidding statute is written (if ever). The devil, as always, is in the details.

PS: When I said competitive bidding offers a good way to think about many important aspects of Medicare, I was not kidding. Though I’ve posted a lot on the subject, I’ve barely scratched the surface.