Earlier this year, with colleagues Zoe Lyon and Garret Johnson, I published a paper in Health Affairs on the quality of provider-offered (aka, vertically integrated) Medicare Advantage contracts,* comparing them to insurer-offered contracts. I wrote about that paper in an Upshot post:

[On a scale of 1 (worst) to 5 (best) stars] an average provider-offered plan has quality ratings that are about one-third of a star higher for both, after adjusting for factors that could confound the comparison, like socioeconomic status and the types and number of doctors where plans are offered.

Our study dug deeper to examine the kinds of quality enhancements available in provider-offered plans. Some aspects of quality are clinically focused. For instance, measures of preventive screening — like that for colorectal cancer — or management of chronic conditions assess the quality of care delivered by doctors and hospitals in a plan’s networks. Provider-offered plans perform somewhat better than insurer-offered plans in such areas.

Other aspects of quality pertain to customer service. In measures of complaints, responsiveness to customers and the enrollees’ overall experiences, provider-offered plans really shine. In each area of customer service we examined, provider-offered plans are rated one-half star higher than insurer-offered ones. (This is a big difference. For comparison, over half of plans are within one star of each other in overall quality.)

Today, joined by Yevgeniy Feyman, we have a new paper, published at BMJ Quality & Safety. It’s the same sample and analysis as the Health Affairs paper, but focused on more granular measures of quality.

You see, Medicare Advantage quality is captured by dozens of clinical and customer service related metrics. These are then rolled up into nine domains covering broad dimensions of quality, like rates of receipt of screenings, tests, and vaccines (for Part C) and drug pricing and patient safety (for Part D). These are further rolled up into an overall Part C and Part D quality score and, finally, to an overall Part C+D score. Everything is in the metric of stars (1-5).

The Health Affairs paper covered just the overall and domain level scores. The new BMJ Quality & Safety paper covers the finest-level metrics. (Our original submission to Health Affairs included both, but reviewers didn’t want so much detail. So, we yanked the fine level stuff, which is why we sought another venue to publish it. Welcome to academia.)

Given the nature of the data, it should be no surprise that our findings are broadly consistent with our prior work. Some examples:

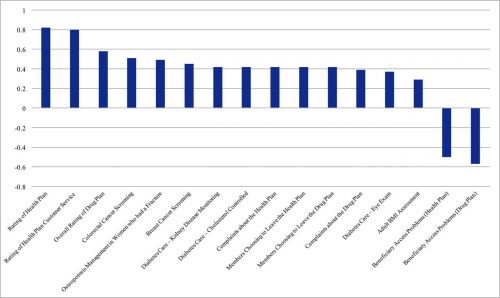

Enrollees in provider-offered contracts are more likely to receive recommended colorectal cancer screening (difference=0.51 SD; p<0.001), recommended breast cancer screenings (difference=0.45 SD; p<0.001), and for patients with diabetes, recommended cholesterol screenings (difference=0.42 SD; p<0.001) and kidney disease monitoring (difference=0.42 SD; p<0.001) [see the figure below].

In contrast, in two measures related to access and administrative performance, provider-offered contracts performed significantly worse than insurer-offered contracts. Provider-offered contracts tended to have more corrective actions taken due to access and performance problems (difference=0.50 SD; p<0.001) and had a higher rate of problems with beneficiary access to providers (difference=0.57 SD; p<0.001). Nonetheless, fewer members chose to leave the provider-offered contracts (difference=0.42 SD, p<0.001), provider-offered contracts had fewer complaints (difference=0.42 SD, p<0.001), and tended to offer better customer service to patients (difference=0.80 SD; p<0.001).

The following figure from the paper shows the adjusted** quality differences between provider-offered and insurer-offered Medicare Advantage contracts that were statistically significant (click to enlarge). Results are displayed in units of standard deviations. A positive value indicates that provider-offered contracts performed better than insurer-offered ones.

Both the Health Affairs and the BMJ Quality & Safety papers follow an earlier HSR publication on vertically integrated MA plans, by me, Roger Feldman, and Steve Pizer, with consistent findings.

* Under a single contract, an MA insurer can offer multiple plans. Quality reporting is at the contract level. Hence, so is our analysis. However, these details are not essential to convey the stylized facts to an Upshot audience. And stylized facts are all one can ever hope to impart. Nobody outside the wonkosphere knows what an “MA contract” is. Everybody thinks in terms of plans and insurers. So my Upshot piece used “plan” when “contract” would have been, technically, more precise. Don’t @ me. This is totally fine.

** Adjusters include the same set of covariates used in prior work: MA Herfindahl-Hirschman Index, county MA enrolment, benchmark payment rate, the proportion of other MA parent organisations that were provider offered, FFS Medicare standardised per capita costs and average beneficiary risk score, percentages of adult residents with at least a high school diploma and with at least 4 years of college, percentages of workers in manufacturing and in construction, poverty rate of those ages 65 and older, per capita income, the proportion of the elderly above 75 years old, urban or rural status, and physicians and hospital beds per 1000 people.