One route to improving health outcomes and potentially reducing health care spending is to focus on individuals with chronic conditions. It’s possible that reducing cost sharing for certain health goods and services for those with chronic illnesses could be cost effective and possibly cost saving.

That’s one policy conclusion suggested by a new NBER publication by Jean Abraham, Anne Royalty, and Thomas DeLeire. It explores the generosity of employer-sponsored insurance for those with and without chronic health conditions. Using nationally representative Medicare Expenditure Panel Survey data from 1997-2007 the authors find that

the chronically ill have less generous insurance coverage than the non-chronically ill. Additional analyses suggest that the reason for this less generous coverage is not that households with a chronically ill member are in different, less generous plans, on average. Rather, households with a chronically ill member have higher spending on certain types of medical services (e.g., pharmaceutical drugs) that are covered less generously by insurance. Given recent work on value-based insurance design and coinsurance as an obstacle to medication adherence, our findings suggest that the current design of health plans may put the health and financial well-being of the chronically ill at risk.

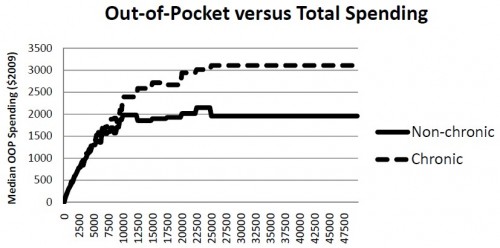

In the following figure from the paper, total spending is on the horizontal axis and median out-of-pocket spending is on the vertical axis. Relative to those with no members with a chronic condition, households with a member with a chronic condition (cancer, diabetes, heart disease, asthma, and anxiety or depression) have higher median OOP spending when total spending is above about $5,000. At the high end of the spending distribution, the gap in median OOP spending is over $1,000.

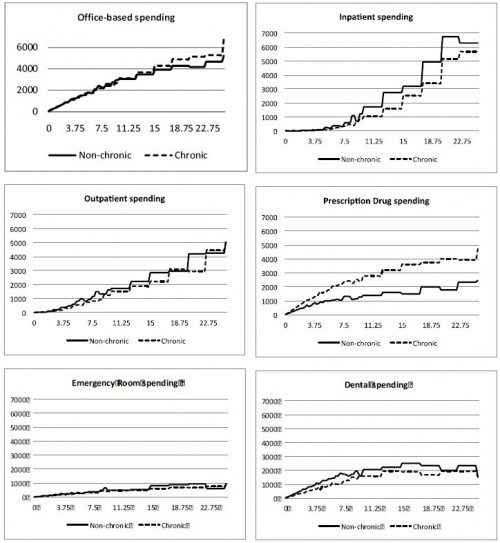

Most of the difference in OOP spending is due to prescription drugs, as shown in the following set of figures.

The authors explain,

Specifically, we find that it is greater coinsurance for prescription drugs, controlling for total healthcare spending that appears to be responsible for the less generous coverage of the chronically ill. That is, the specific services used most by the chronically ill – prescription drugs—are, by design, reimbursed at a lower rate. This is not due to the higher overall expenditures on average of the chronically ill, since we control for total spending in all of our analyses. […]

[P]olicymakers concerned about health outcomes as well as cost control may look to recent evidence on coinsurance as an obstacle to medication adherence and question whether it is desirable to deter those with chronic conditions from taking needed medications. Additionally, some recent work showing that health care cost savings generated by lower medication adherence lead to higher spending on other services such as inpatient and outpatient care suggests the possibility that higher coinsurance for this group could lead to increases in overall healthcare costs.

One might also ask if it is fair that those with chronic illness pay more than those without. That is, to what extent should insurance be a transfer from the healthy to the sick? Does your answer depend on whether you believe the sickness is related to individual behavior and lifestyle choices? To what extent is your answer based on your personal experience with chronic illness, either your own or that of a family member or friend? Should our opinions about policy be driven by such things?