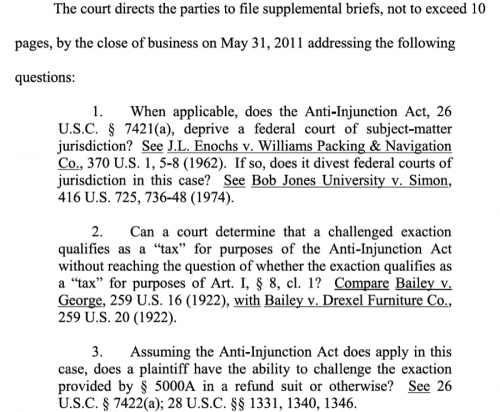

The 4th Circuit panel on the ACA litigation has ordered special briefing on the non-constitutional tax issue – if the individual mandate is a tax (and it is found in Section 5000A of the Internal Revenue Code), it is probably covered by the Anti-Injunction Act. Many potential arguments on both sides here (my December analysis included prior 4th Circuit precedent), and the 4th Circuit panel appears eager to hear more. The Court’s unanimous order:

h/t to BNA (alas, gated)