My latest post on CBO’s projections of federal revenue and spending generated a lot of interest. First, let me be clear, I was not and am not arguing for any particular tax policy. My interest, as always, is to reason about health policy based on what can and cannot (or might and most likely will not) be amenable to change. Is our level of taxation something that is likely to change or not?

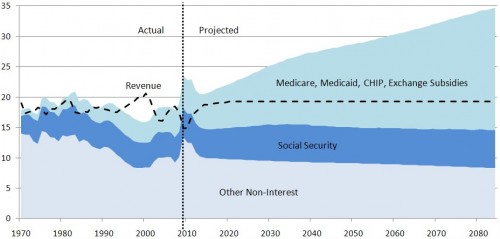

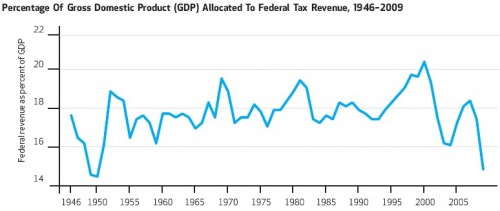

The CBO has been projecting for years that long-run federal revenue (tax receipts) will be just shy of 20% of GDP. As best I can tell, that’s what they think because that’s how things have mostly always been. Marginal tax rates have gone up and down a lot, but federal revenue as a percent of GDP has stayed within a fairly tight band, centered on about 18% of GDP. Here are the relevant figures from the CBO and Joe Newhouse, again.

Percent of GDP: Alternative Fiscal Scenario (excludes interest on the debt)

If we’re to keep pace with health care spending (top figure above), and, moreover, if we’re to keep pace with health care spending plus interest on the debt, which is growing even faster than health care, we’ll have to tax ourselves at much higher rates than in the past (figure just above). Can we? Will we?

Some people think so. One source of support for the argument that we might is the following figure from the Tax Policy Center. It reports total taxation, from all levels of government, as a percent of GDP for the 30 OECD member nations. The U.S. taxation level is way below average.

I think you can read this chart in various ways. Is this evidence that the U.S. could tax itself more? Yes. Is this evidence that the U.S. citizenry will accept higher levels of taxation and the associated larger role of government? No. I think the historical record of taxation levels in the U.S. is more compelling. The CBO thinks so too. But I don’t think this is the point we should be arguing.

Of course it is possible we could tax ourselves more. But if we consider doing so, we should look at what we’re getting for that money. Spending ever more treasure on a wasteful health system that doesn’t produce particularly good health outcomes is not a good use of the money. Put another way, if we tax and spend 10 percentage points more of GDP on health care, that might buy us another 50 years of spending the way we do now. That’s not something we should be fired up to do. It’s something we should be fighting hard to avoid.

I’d rather that in 50 years we are spending more wisely on health care. I’m not saying we should necessarily hold the line at federal revenue of 20% GDP. I’m saying we are going to have to hold the line somewhere, and I’d bet my life savings that we’re not going to end up above the OECD mean taxation level. Thus, we will have to come to terms with health spending in the next several decades. Why not start now?