Medicare Advantage plans consume more taxpayer money per beneficiary than FFS. This is a fact.

That’s not to say MA plans can’t achieve lower costs, only that taxpayers aren’t getting the benefit if and when they do. Beneficiaries do derive some benefit from the over-payments, but only at the rate of 14 cents on the dollar (that does not mean the other 86 cents is plan profit, more here). It is also true that there are some spillover effects. FFS costs may be lower when MA enrollment is higher, but to my knowledge, this has not been quantified with data more recent than 2001. A lot has changed in the MA program since then. The size of the spillover today is uncertain, as far as I know (happy to be corrected on this).

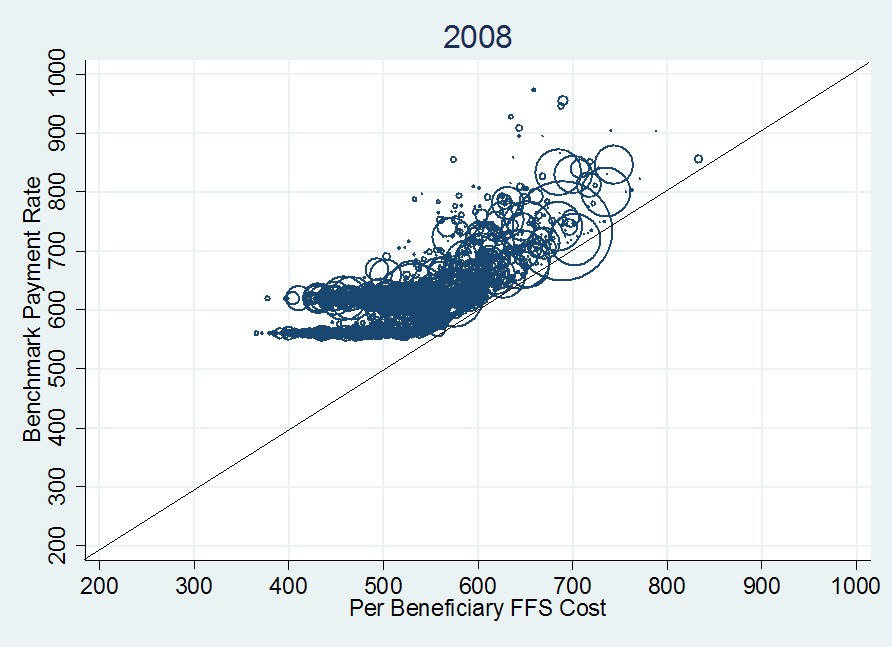

But back to taxpayer costs. Below is a figure I’ve posted before that illustrates the relationship between MA payments and FFS costs. (Actually, it shows “benchmarks,” not payments, because plan-level payments aren’t available to me as a researcher. But we know from MedPAC that payments are only a few percentage points below benchmarks on average, and still well above FFS costs.)

In this figure, each circle is a county and its size is proportional to the county’s MA enrollment. Circles centered above the 45-degree line correspond to payments (benchmarks) above FFS costs. All the circle centers are above the line. Additional details are in a prior post.

Given the fact that MA plans are paid above FFS costs, you’d think folks in favor of harnessing the efficiency of the market to achieve taxpayer savings would be appalled. I am. This has got to stop. And that does not mean “eliminate private plans.” It means “stop overpaying them.” There are a lot of ways that could be achieved. I prefer a competitive bidding approach that includes FFS among the bidders. Details next week.