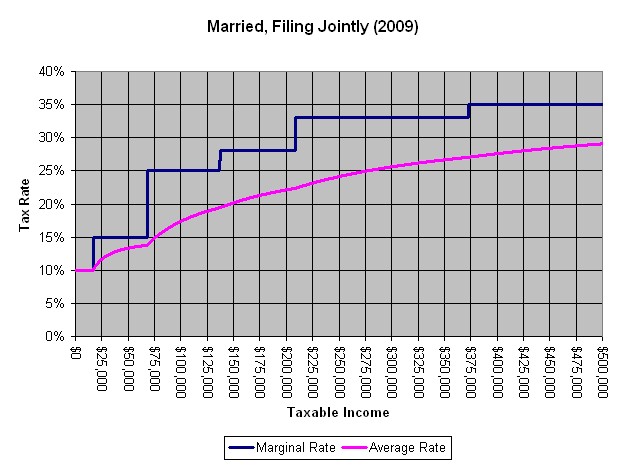

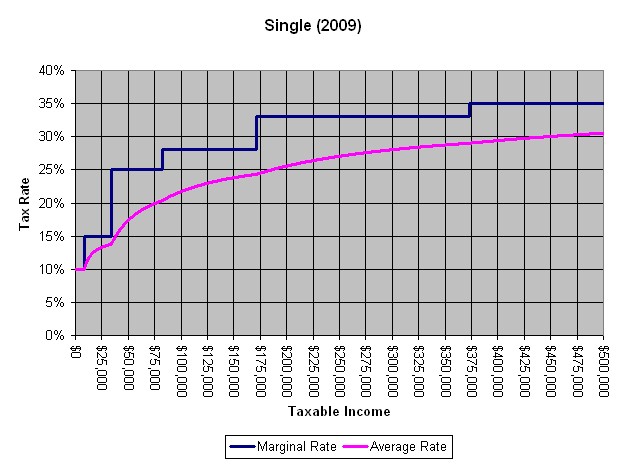

I don’t need to write a post on the difference between marginal and average income tax rates. There are already perfectly good explanations available elsewhere (see list at the end of this post). In brief, your marginal tax rate is the tax paid on the last dollar earned. Often this is what people mean when referencing their “tax bracket.” Your average tax rate is simply your tax paid divided by your taxable income.

The purpose of this post is to show off graphs that illustrate the difference between marginal and average federal income tax rates (state and payroll taxes excluded). A while back I wanted graphs like this but couldn’t find any online. So I made them myself. They’re included below and also in an online Excel spreadsheet that has the data on which they’re based. All figures and data are for federal income tax for the 2009 tax year.

For more on marginal versus average tax rates see any of: